Government Initiatives and Support

The Chinese government plays a pivotal role in fostering the cloud infrastructure-services market through various initiatives and policies aimed at promoting technological innovation. The government has introduced favorable regulations and funding programs to encourage the adoption of cloud technologies among enterprises. For instance, the 'New Infrastructure' initiative emphasizes the development of digital infrastructure, including cloud computing. This support is likely to enhance the market's growth trajectory, as businesses are incentivized to migrate to cloud platforms. Furthermore, the government's commitment to building a robust digital economy is expected to create a conducive environment for cloud service providers, thereby expanding the cloud infrastructure-services market significantly in the coming years.

Emergence of Innovative Cloud Solutions

The cloud infrastructure-services market in China is witnessing the emergence of innovative cloud solutions that cater to evolving business needs. Providers are increasingly offering specialized services such as serverless computing, containerization, and multi-cloud strategies. These innovations enable organizations to optimize their cloud environments and enhance operational efficiency. The growing trend of adopting microservices architecture further supports this shift, as businesses seek to develop and deploy applications more rapidly. As companies embrace these innovative solutions, the cloud infrastructure-services market is likely to experience substantial growth. The continuous evolution of cloud technologies, coupled with the demand for tailored solutions, positions the market for a dynamic future, where adaptability and innovation are key drivers.

Growing Demand for Digital Transformation

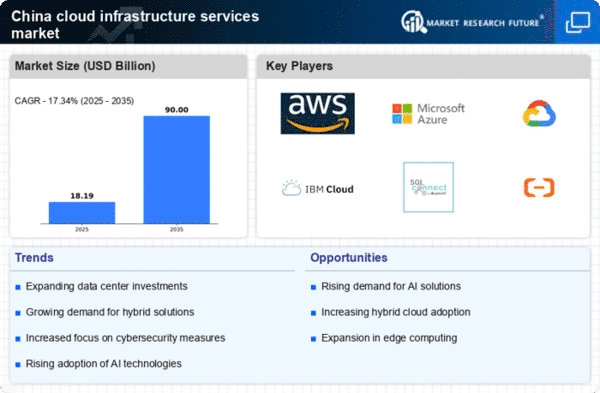

The cloud infrastructure-services market in China is experiencing a surge in demand driven by the ongoing digital transformation across various sectors. Enterprises are increasingly adopting cloud solutions to enhance operational efficiency and agility. According to recent data, the market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is fueled by the need for businesses to modernize their IT infrastructure, streamline processes, and improve customer experiences. As organizations transition to digital platforms, the reliance on cloud services becomes paramount, thereby propelling the cloud infrastructure-services market forward. The integration of advanced technologies such as AI and big data analytics further amplifies this trend, as companies seek to leverage cloud capabilities for data-driven decision-making.

Enhanced Focus on Data Security and Privacy

Data security and privacy concerns are paramount in the cloud infrastructure-services market, particularly in China, where regulatory frameworks are becoming increasingly stringent. Organizations are compelled to adopt cloud solutions that prioritize robust security measures to protect sensitive information. The implementation of regulations such as the Personal Information Protection Law (PIPL) has heightened awareness regarding data protection. Consequently, cloud service providers are investing in advanced security technologies and compliance frameworks to meet these regulatory requirements. This focus on security not only builds trust among consumers but also drives the adoption of cloud services, thereby propelling the growth of the cloud infrastructure-services market. As businesses prioritize data integrity, the demand for secure cloud solutions is expected to rise significantly.

Rising Need for Scalability and Flexibility

In the context of the cloud infrastructure-services market, the increasing need for scalability and flexibility is a critical driver. Businesses in China are recognizing the importance of scalable solutions that can adapt to fluctuating demands. This trend is particularly evident in sectors such as e-commerce and finance, where rapid growth necessitates agile IT infrastructure. The ability to scale resources up or down based on real-time requirements allows organizations to optimize costs and enhance performance. As a result, cloud service providers are focusing on offering flexible solutions that cater to diverse business needs. This shift towards scalable cloud services is likely to contribute to the overall expansion of the cloud infrastructure-services market in China.