Surge in IoT Device Adoption

The proliferation of Internet of Things (IoT) devices is significantly influencing the big data-analytics market. With millions of devices generating vast amounts of data daily, organizations in China are increasingly turning to analytics solutions to harness this information. The number of connected IoT devices is projected to exceed 1 billion by 2025, creating a wealth of data that can be analyzed for insights. This surge in data generation necessitates advanced analytics capabilities, thereby driving demand for big data solutions. Consequently, businesses are investing in analytics tools to process and analyze IoT data, which is expected to contribute to the overall growth of the big data-analytics market.

Government Initiatives and Support

Government initiatives aimed at fostering technological innovation play a crucial role in the expansion of the big data-analytics market. In China, various policies have been implemented to promote the adoption of big data technologies across industries. For instance, the government has allocated substantial funding to support research and development in data analytics, which is expected to reach $10 billion by 2026. These initiatives not only encourage private sector investment but also facilitate collaboration between public and private entities. As a result, the big data-analytics market is likely to experience accelerated growth, driven by enhanced infrastructure and increased access to data resources.

Advancements in Data Processing Technologies

Technological advancements in data processing are significantly impacting the big data-analytics market. Innovations such as machine learning and real-time data processing are enabling organizations in China to analyze large datasets more efficiently. The introduction of cloud-based analytics solutions has further enhanced data accessibility and processing capabilities. As a result, businesses can derive insights from data at unprecedented speeds, which is crucial for maintaining a competitive edge. The market for data processing technologies is expected to grow substantially, with projections indicating a potential increase of 30% in the next few years. This evolution in data processing is likely to drive further adoption of big data analytics solutions.

Rising Demand for Data-Driven Decision Making

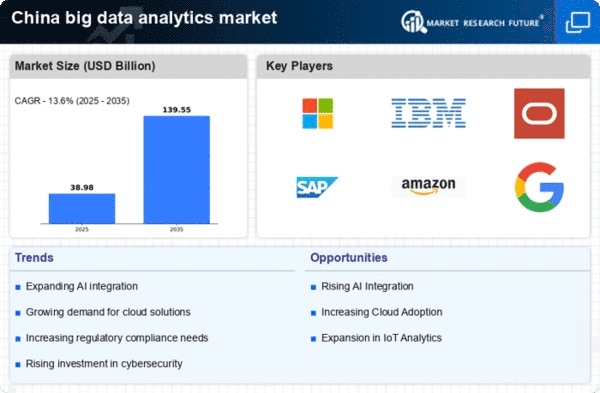

The increasing emphasis on data-driven decision making is a pivotal driver for the big data-analytics market. Organizations across various sectors in China are recognizing the value of leveraging data insights to enhance operational efficiency and customer satisfaction. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. This trend is particularly evident in industries such as retail and finance, where data analytics is utilized to optimize inventory management and risk assessment. As businesses strive to remain competitive, the integration of advanced analytics into their strategic frameworks becomes essential, thereby propelling the growth of the big data-analytics market.

Growing Focus on Customer Experience Enhancement

Enhancing customer experience has emerged as a critical priority for businesses in China, thereby driving the big data-analytics market. Companies are increasingly utilizing data analytics to gain insights into customer preferences and behaviors, enabling them to tailor their offerings accordingly. Research indicates that organizations that leverage data analytics for customer experience improvements can achieve up to a 20% increase in customer satisfaction. This focus on personalization and customer engagement is prompting businesses to invest in advanced analytics tools, which in turn fuels the growth of the big data-analytics market. As competition intensifies, the ability to understand and respond to customer needs becomes paramount.