Advancements in Material Science

Innovations in material science are significantly influencing the Chemical Vapor Deposition Market CVD Market. The development of new materials, such as 2D materials and high-k dielectrics, necessitates advanced deposition techniques to achieve desired properties and performance. CVD processes are increasingly being utilized to synthesize these materials, which are essential for next-generation electronic devices and energy applications. The market for advanced materials is expected to grow substantially, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This trend indicates that the Chemical Vapor Deposition Market CVD Market will likely benefit from the ongoing research and development efforts aimed at enhancing material properties and expanding application areas.

Rising Demand for Semiconductors

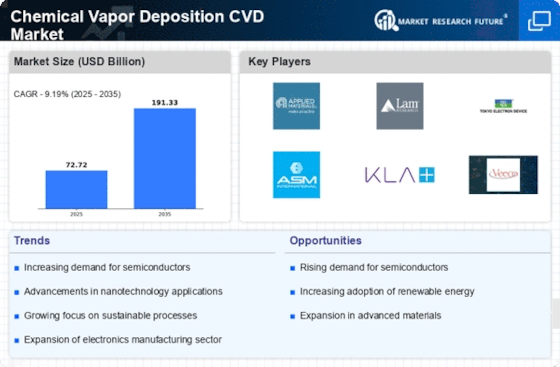

The Chemical Vapor Deposition Market CVD Market is experiencing a notable surge in demand for semiconductors, driven by the increasing reliance on electronic devices across various sectors. As industries such as automotive, telecommunications, and consumer electronics expand, the need for advanced semiconductor materials becomes paramount. The semiconductor market is projected to reach approximately 1 trillion USD by 2030, indicating a robust growth trajectory. CVD processes are essential for producing high-quality thin films and coatings, which are critical in semiconductor fabrication. This rising demand for semiconductors is likely to propel the Chemical Vapor Deposition Market CVD Market, as manufacturers seek efficient and reliable deposition techniques to meet the evolving technological requirements.

Growth in Renewable Energy Sector

The Chemical Vapor Deposition Market CVD Market is poised to benefit from the expanding renewable energy sector, particularly in the production of photovoltaic cells and energy storage systems. As the world shifts towards sustainable energy solutions, the demand for efficient and high-performance materials is increasing. CVD techniques are employed to create thin films for solar cells, which enhance their efficiency and durability. The solar energy market is projected to grow at a compound annual growth rate of around 20% through 2030, indicating a substantial opportunity for the Chemical Vapor Deposition Market CVD Market. This growth is likely to drive innovation and investment in CVD technologies tailored for renewable energy applications.

Increased Focus on Nanotechnology

The Chemical Vapor Deposition Market CVD Market is significantly influenced by the growing interest in nanotechnology. As industries explore the potential of nanoscale materials and devices, the demand for precise and controlled deposition techniques becomes critical. CVD processes are well-suited for producing nanostructured materials, which are essential in various applications, including electronics, healthcare, and environmental technologies. The Chemical Vapor Deposition Market CVD is expected to reach approximately 125 billion USD by 2024, suggesting a robust growth potential. This trend indicates that the Chemical Vapor Deposition Market CVD Market may experience increased demand as researchers and manufacturers seek advanced deposition methods to harness the unique properties of nanomaterials.

Regulatory Support for Advanced Manufacturing

The Chemical Vapor Deposition Market CVD Market is likely to benefit from increasing regulatory support for advanced manufacturing processes. Governments are recognizing the importance of fostering innovation and competitiveness in manufacturing sectors, leading to initiatives that promote the adoption of advanced technologies, including CVD. Such regulatory frameworks may provide funding, incentives, and resources to support research and development in CVD techniques. As industries strive to enhance production efficiency and sustainability, the Chemical Vapor Deposition Market CVD Market could see a rise in investment and growth opportunities, driven by favorable policies and support mechanisms aimed at advancing manufacturing capabilities.