Sustainability Initiatives

Sustainability initiatives are becoming increasingly relevant in the Global Ceramic Inks Market Industry. As environmental concerns rise, manufacturers are focusing on developing eco-friendly ceramic inks that minimize harmful emissions and reduce waste. This shift towards sustainable practices not only meets regulatory requirements but also aligns with consumer preferences for environmentally responsible products. Companies that invest in sustainable technologies are likely to gain a competitive advantage in the market. The emphasis on sustainability is expected to contribute to the overall growth of the Global Ceramic Inks Market Industry, as consumers increasingly prioritize eco-friendly options in their purchasing decisions.

Expansion of End-Use Industries

The Global Ceramic Inks Market Industry benefits from the expansion of various end-use industries, including automotive, electronics, and home decor. As these sectors grow, the demand for high-quality ceramic inks increases, driven by the need for durable and visually appealing products. For instance, the automotive industry utilizes ceramic inks for decorative elements and functional coatings, enhancing both aesthetics and performance. This diversification of applications is likely to bolster the market's growth trajectory. The Global Ceramic Inks Market Industry is poised for substantial growth, supported by the increasing demand from these expanding end-use sectors.

Growing Demand for Customization

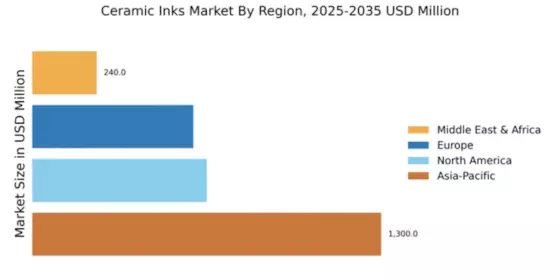

The Global Ceramic Inks Market Industry experiences a notable surge in demand for customized products across various sectors, including ceramics and glass. This trend is driven by consumers' increasing preference for personalized designs and unique aesthetics. As manufacturers adapt to this shift, they are investing in advanced ceramic ink technologies that allow for intricate designs and vibrant colors. The market is projected to reach 2.79 USD Billion in 2024, reflecting this growing inclination towards customization. Companies are likely to leverage digital printing technologies to meet these demands, thereby enhancing their competitive edge in the Global Ceramic Inks Market Industry.

Rising Applications in Interior Design

The Global Ceramic Inks Market Industry is witnessing a rise in applications within the interior design sector. As homeowners and designers seek innovative ways to enhance aesthetics, ceramic inks are increasingly utilized for decorative tiles, wall coverings, and custom ceramics. This trend is fueled by the growing emphasis on interior personalization and the desire for unique home environments. The market's expansion is further supported by the increasing availability of eco-friendly ceramic inks, which align with sustainability trends. By 2035, the market is anticipated to reach 5.72 USD Billion, underscoring the significant role of interior design in driving growth within the Global Ceramic Inks Market Industry.

Technological Advancements in Printing

Technological innovations play a pivotal role in shaping the Global Ceramic Inks Market Industry. The introduction of digital printing technologies has revolutionized the way ceramic inks are applied, enabling higher precision and efficiency. These advancements facilitate the production of complex designs and patterns that were previously challenging to achieve. As a result, manufacturers are increasingly adopting digital printing methods, which are expected to contribute to the market's growth. The Global Ceramic Inks Market Industry is projected to expand significantly, with a compound annual growth rate of 6.74% from 2025 to 2035, indicating a robust future driven by these technological enhancements.