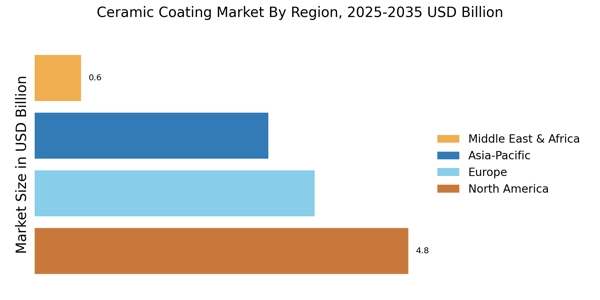

Expansion of Industrial Applications

The Ceramic Coating Market is witnessing an expansion beyond automotive applications into various industrial sectors. Industries such as aerospace, manufacturing, and electronics are increasingly adopting ceramic coatings for their superior thermal resistance and durability. For instance, in aerospace, ceramic coatings are utilized to enhance the performance and lifespan of components exposed to extreme temperatures. This diversification of applications is likely to drive market growth, as industries seek innovative solutions to improve efficiency and reduce maintenance costs. The increasing focus on operational efficiency and product longevity suggests that the Ceramic Coating Market will continue to evolve, catering to a broader range of industrial needs and applications.

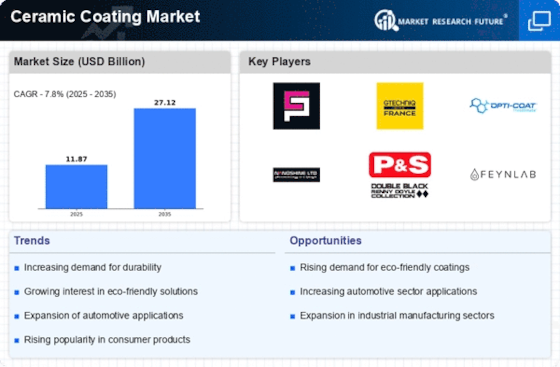

Rising Demand for Vehicle Protection

The Ceramic Coating Market experiences a notable surge in demand for protective coatings, particularly in the automotive sector. As consumers increasingly seek to preserve the aesthetic appeal and longevity of their vehicles, ceramic coatings offer a robust solution against environmental damage, UV rays, and chemical exposure. Recent data indicates that the automotive segment accounts for a substantial share of the market, driven by the growing awareness of vehicle maintenance. This trend is further amplified by the rise in luxury vehicle sales, where owners are more inclined to invest in high-quality protective solutions. Consequently, the Ceramic Coating Market is poised for growth as more consumers recognize the benefits of long-lasting protection, leading to an increase in adoption rates across various vehicle types.

Growing Awareness of Environmental Benefits

The Ceramic Coating Market is increasingly influenced by the growing awareness of environmental sustainability. Consumers and businesses alike are becoming more conscious of the ecological impact of their choices, leading to a preference for eco-friendly products. Ceramic coatings, known for their low VOC emissions and long-lasting properties, align well with these sustainability initiatives. As regulations around environmental standards tighten, the demand for environmentally friendly coatings is likely to rise. This shift in consumer behavior suggests that the Ceramic Coating Market will benefit from the increasing emphasis on sustainable practices, potentially leading to a greater market share for eco-conscious products.

Technological Innovations in Coating Processes

Technological advancements play a pivotal role in shaping the Ceramic Coating Market. Innovations in coating processes, such as the development of advanced application techniques and formulations, enhance the performance characteristics of ceramic coatings. These innovations not only improve adhesion and durability but also expand the range of substrates that can be coated. As manufacturers invest in research and development, the introduction of new products with enhanced properties is expected to attract a wider customer base. The ongoing evolution of coating technologies indicates a promising future for the Ceramic Coating Market, as it adapts to meet the demands of various sectors, including automotive, aerospace, and consumer goods.

Increase in DIY and Professional Application Services

The Ceramic Coating Market is experiencing a notable increase in both DIY enthusiasts and professional application services. As consumers become more knowledgeable about the benefits of ceramic coatings, many are opting for DIY application kits, which are readily available in the market. Simultaneously, professional detailing services are expanding their offerings to include ceramic coating applications, catering to customers who prefer expert installation. This dual approach is likely to enhance market penetration, as it provides consumers with flexible options to suit their preferences. The rise in both DIY and professional services indicates a robust growth trajectory for the Ceramic Coating Market, as it adapts to meet diverse consumer needs.