Market Trends

Key Emerging Trends in the Central Nervous System Biomarkers Market

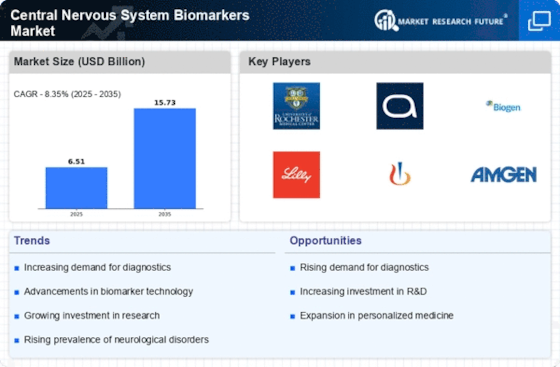

The Central Nervous System Biomarkers market is experiencing dynamic shifts in response to advancements in neurology research and diagnostics. Several factors are influencing market trends, reflecting a growing understanding of neurological disorders and the need for effective diagnostic tools. One of the key drivers is the increasing prevalence of central nervous system disorders, such as Alzheimer's and Parkinson's diseases. As the global population ages, the demand for accurate biomarkers to aid in early detection and monitoring of these conditions is on the rise. The evolution in technology especially in the subjects of genomics and proteomics has provided an opportunity for the inducement of new biomarkers. With these technological advancements it is now possible to detect biomarkers associated with various CNS disorders more effectively and reliably, which has further catalyzed the market growth. The need for biomarkers that would reveal the underlying causes of neurological disorders, disease onset and how it will progress has been promoted by the fact that neurological disorders are mostly characterized by early detection. A growing awareness of the importance of CNS biomarkers in advancing early intervention and individualized treatment approaches is taking place among researchers and healthcare professionals. Research and development activities have already emerged and advanced in academia and the pharmaceutical industry and the market is seeing it through. A spur of partnerships between research institutions and biotechnology companies hastens the discovery and validation of CNS markers hence enhancing the market’s momentum. It has been an age epitomized with era of precision medicine aims to prove the individual patient profile driven personalized treatment principles. Biomarkers that relate to the CNS are central in the identification of particular molecular patterns, and this allows health care provider to administer personalize treatment protocols on individuals with the neurological disorders. As with biomarker development, investment focus has shifted from drugs to CNS biomarkers as awareness is growing in the context of the potential effect of CNS biomarkers on patient outcomes. Due to investment from various organizations both within the public and private sectors, biomarkers for several CNS disorders are being discovered and validated. The importance of CNS biomarkers for enhancing diagnostic accuracy and patient outcomes is recognized by regulatory bodies. Sympathy regulatory arrangements and momentum toward normatarizatsiya encourage trust of participants, aid in development of market CNS Biomarkers. As the understanding of central nervous system disorders deepens and technology continues to advance, the CNS Biomarkers market is poised for significant expansion. Continued collaboration, technological innovation, and a focus on personalized medicine are expected to shape the future landscape of this dynamic market.

Leave a Comment