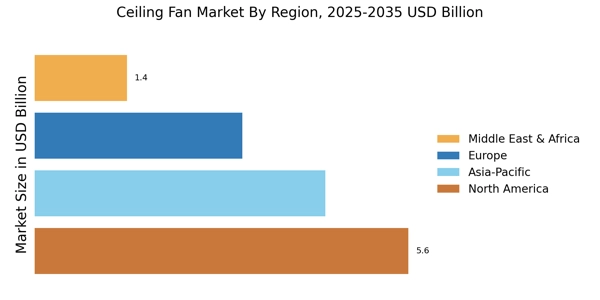

North America : Market Leader in Innovation

North America is the largest market for ceiling fans, accounting for approximately 45% of the global market share. The region's growth is driven by rising consumer demand for energy-efficient cooling solutions and advancements in smart home technology. Regulatory initiatives promoting energy efficiency, such as the Energy Star program, further catalyze market expansion. The U.S. leads this market, followed closely by Canada, which holds about 15% of the market share. The competitive landscape in North America is robust, featuring key players like Hunter Fan Company, Emerson Electric Co., and Minka Aire. These companies are at the forefront of innovation, offering a range of stylish and energy-efficient ceiling fans. The presence of established brands and a growing trend towards home automation are expected to sustain market growth. Additionally, the increasing focus on sustainable living is pushing manufacturers to develop eco-friendly products.

Europe : Emerging Market with Potential

Europe is witnessing a growing demand for ceiling fans, driven by increasing awareness of energy efficiency and sustainability. The market is projected to grow steadily, with countries like Germany and the UK leading the charge, holding approximately 25% and 20% of the market share, respectively. Regulatory frameworks, such as the EU's Ecodesign Directive, are encouraging manufacturers to innovate and produce energy-efficient products, further boosting market growth. The competitive landscape in Europe is characterized by a mix of local and international players, including prominent brands like Westinghouse Lighting Corporation and Fanimation. The market is also seeing an influx of new entrants focusing on design and functionality. As consumers increasingly seek stylish and efficient cooling solutions, the presence of key players and innovative designs will play a crucial role in shaping the market's future.

Asia-Pacific : Rapid Growth in Emerging Markets

Asia-Pacific is rapidly emerging as a significant player in the ceiling fan market, driven by urbanization and rising disposable incomes. Countries like India and China are the largest markets in the region, collectively holding around 35% of the global market share. The demand for ceiling fans is fueled by the need for affordable cooling solutions in hot climates, along with government initiatives promoting energy-efficient appliances, which are expected to further enhance market growth. The competitive landscape in Asia-Pacific is diverse, with both local and international brands vying for market share. Key players such as Kichler Lighting and Monte Carlo Fans are expanding their presence in this region. The increasing focus on design and technology integration, such as smart ceiling fans, is also shaping the competitive dynamics. As the market continues to grow, innovation and affordability will be key drivers for success.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region presents significant untapped potential in the ceiling fan market, driven by increasing temperatures and a growing middle class. Countries like South Africa and the UAE are leading the market, holding approximately 15% and 10% of the market share, respectively. The demand for ceiling fans is expected to rise as consumers seek cost-effective cooling solutions, supported by government initiatives promoting energy efficiency and sustainability in building practices. The competitive landscape in this region is evolving, with both established brands and new entrants looking to capitalize on the growing demand. Key players are focusing on innovative designs and energy-efficient products to cater to the unique needs of consumers. As awareness of the benefits of ceiling fans increases, the market is likely to see substantial growth in the coming years.