Cbd Skincare Products Size

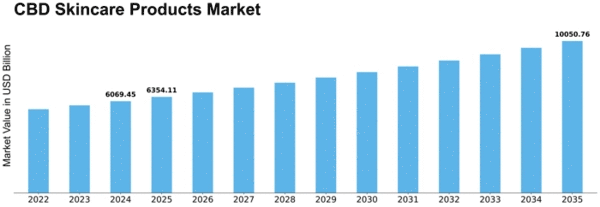

CBD Skincare Products Market Growth Projections and Opportunities

The CBD skincare products market operates within a dynamic landscape influenced by various factors, including regulatory changes, consumer preferences, and scientific research. CBD, or cannabidiol, derived from the cannabis plant, has gained popularity in skincare products for its potential therapeutic benefits, including anti-inflammatory and antioxidant properties.

Consumer preferences play a significant role in shaping the dynamics of the CBD skincare products market. As consumers become more health-conscious and seek natural alternatives to traditional skincare ingredients, there is a growing demand for CBD-infused products. CBD skincare products appeal to consumers looking for solutions to common skin concerns such as acne, inflammation, redness, and aging. Additionally, CBD's purported calming and soothing effects make it attractive to individuals with sensitive or reactive skin.

Technological advancements have also contributed to the growth of the CBD skincare products market, leading to the development of innovative formulations and delivery systems. CBD is a versatile ingredient that can be incorporated into various skincare products, including moisturizers, serums, cleansers, and masks. Advanced extraction techniques and nanoemulsion technology have improved the bioavailability and efficacy of CBD in skincare formulations, allowing for better absorption and penetration into the skin.

Furthermore, scientific research and clinical studies play a crucial role in driving consumer confidence and acceptance of CBD skincare products. While research on the therapeutic benefits of CBD for skincare is still in its early stages, preliminary studies suggest that CBD may have anti-inflammatory, antioxidant, and anti-aging properties that can benefit the skin. As more scientific evidence emerges to support these claims, consumers are likely to become more receptive to CBD skincare products and incorporate them into their skincare routines.

Market competition within the CBD skincare products industry is intense, with numerous brands and manufacturers vying for market share. Brands differentiate themselves through product innovation, marketing strategies, and partnerships with skincare experts and influencers to promote their products. Additionally, the rise of e-commerce and online beauty retailers has expanded the reach of CBD skincare products, allowing smaller brands and indie labels to compete alongside established players in the market.

Moreover, regulatory changes and legal considerations impact the dynamics of the CBD skincare products market. While CBD derived from hemp is legal in many countries, regulations surrounding its use in skincare products vary by region. In some markets, strict regulations and labeling requirements may limit the availability and marketing of CBD skincare products, while in others, more lenient regulations may foster a competitive marketplace. Additionally, concerns about product quality, purity, and safety remain key considerations for consumers when purchasing CBD skincare products.

The COVID-19 pandemic has also influenced the dynamics of the CBD skincare products market, with changes in consumer behavior and priorities shaping product demand. As people spent more time at home and adopted self-care rituals, there was a surge in demand for skincare products, including CBD-infused options. Additionally, as consumers became more health-conscious and focused on boosting their immune systems, there was increased interest in natural and holistic skincare solutions like CBD.

In conclusion, the CBD skincare products market is characterized by dynamic forces driven by consumer preferences, technological advancements, regulatory changes, and market competition. As demand for natural and therapeutic skincare solutions continues to grow, companies must stay agile and innovative to meet the evolving needs of consumers. By understanding and leveraging these market dynamics, businesses can capitalize on the popularity of CBD skincare products and contribute to the transformation of the skincare industry.

Leave a Comment