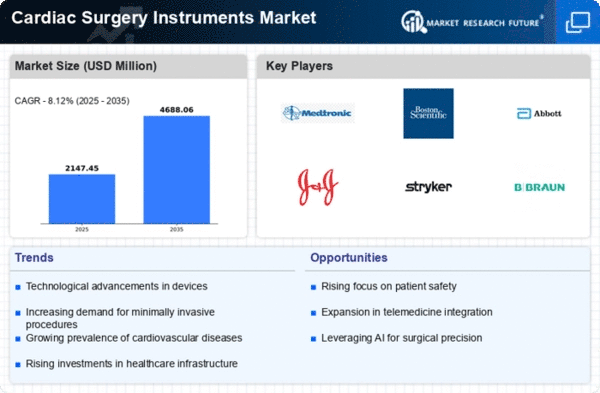

Market Growth Projections

The Global Cardiac Surgery Instruments Market Industry is projected to experience substantial growth over the next decade. With an expected market size of 1.99 USD Billion in 2024, the industry is anticipated to expand to 4.69 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 8.11% from 2025 to 2035. Such projections reflect the increasing demand for advanced surgical instruments driven by factors such as rising cardiovascular disease prevalence, technological advancements, and growing healthcare expenditures. The market's expansion is indicative of a broader trend towards improved surgical outcomes and patient care.

Growing Geriatric Population

The global increase in the geriatric population is a critical driver of the Global Cardiac Surgery Instruments Market Industry. Older adults are more susceptible to cardiovascular diseases, necessitating surgical interventions. As life expectancy rises, the demand for cardiac surgeries is likely to escalate, leading to a higher requirement for specialized instruments. This demographic shift is particularly pronounced in developed nations, where healthcare systems are adapting to cater to the needs of aging populations. The anticipated growth in this sector is substantial, with market values projected to rise from 1.99 USD Billion in 2024 to 4.69 USD Billion by 2035, indicating a CAGR of 8.11% from 2025 to 2035.

Regulatory Support and Standards

Regulatory frameworks and standards play a pivotal role in shaping the Global Cardiac Surgery Instruments Market Industry. Governments and health organizations are increasingly establishing guidelines to ensure the safety and efficacy of surgical instruments. This regulatory support fosters innovation and encourages manufacturers to develop advanced tools that meet stringent quality standards. As a result, the market is likely to benefit from enhanced consumer confidence and increased adoption of new technologies. This supportive environment is expected to contribute to the market's growth trajectory, with projections indicating a rise from 1.99 USD Billion in 2024 to 4.69 USD Billion by 2035.

Increasing Healthcare Expenditure

The rise in global healthcare expenditure significantly influences the Global Cardiac Surgery Instruments Market Industry. Governments and private sectors are investing more in healthcare infrastructure, which includes the procurement of advanced surgical instruments. As healthcare systems evolve, there is a growing emphasis on improving surgical facilities and patient care. This trend is particularly evident in emerging economies, where increased funding is directed towards modernizing healthcare services. Consequently, the market is expected to expand, with projections indicating a growth from 1.99 USD Billion in 2024 to 4.69 USD Billion by 2035, reflecting a robust CAGR of 8.11% from 2025 to 2035.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases globally drives the demand for cardiac surgery instruments. As populations age and lifestyle-related health issues become more prevalent, the Global Cardiac Surgery Instruments Market Industry is poised for growth. For instance, cardiovascular diseases are projected to remain the leading cause of mortality worldwide, necessitating advanced surgical interventions. This trend is reflected in the market's expected valuation of 1.99 USD Billion in 2024, with a significant increase anticipated to 4.69 USD Billion by 2035. Such growth indicates a compound annual growth rate (CAGR) of 8.11% from 2025 to 2035, underscoring the urgent need for innovative surgical tools.

Technological Advancements in Surgical Instruments

Technological innovations in cardiac surgery instruments enhance surgical precision and patient outcomes, thereby propelling the Global Cardiac Surgery Instruments Market Industry. Developments such as minimally invasive techniques and robotic-assisted surgeries are becoming increasingly prevalent. These advancements not only reduce recovery times but also minimize complications associated with traditional surgical methods. As hospitals and surgical centers adopt these cutting-edge technologies, the demand for sophisticated instruments rises. This shift is indicative of a broader trend towards improved surgical efficacy, which is likely to contribute to the market's projected growth from 1.99 USD Billion in 2024 to 4.69 USD Billion by 2035.