Growth in Personal Care and Cosmetics

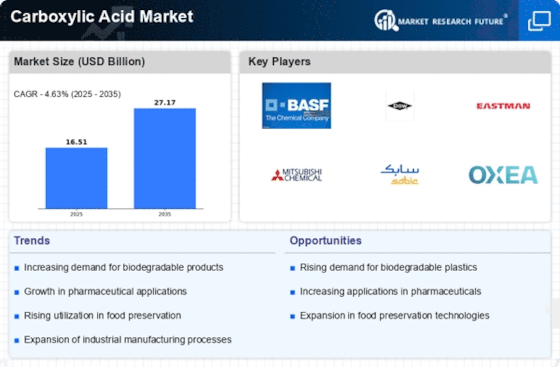

The Carboxylic Acid Market is witnessing growth driven by the rising demand for personal care and cosmetic products. Carboxylic acids, such as salicylic acid and lactic acid, are integral components in skincare formulations, known for their exfoliating and antibacterial properties. The increasing consumer awareness regarding skincare and the preference for products that promote skin health are likely to bolster the market. In 2023, the personal care segment accounted for approximately 20% of the total carboxylic acid consumption, indicating a substantial market share. As the trend towards natural and organic personal care products continues, the carboxylic acid market may experience further expansion in this domain.

Expanding Applications in Pharmaceuticals

The Carboxylic Acid Market is significantly influenced by its expanding applications in the pharmaceutical sector. Carboxylic acids serve as key intermediates in the synthesis of various pharmaceutical compounds, including analgesics, anti-inflammatory drugs, and antibiotics. The increasing prevalence of chronic diseases and the rising demand for effective medications are propelling the growth of this market. In 2023, the pharmaceutical industry represented around 25% of the total carboxylic acid consumption, highlighting its critical role. As research and development efforts intensify, the potential for new drug formulations utilizing carboxylic acids may further enhance market dynamics, suggesting a promising outlook for the industry.

Rising Demand in Food and Beverage Sector

The Carboxylic Acid Market is experiencing a notable increase in demand from the food and beverage sector. Carboxylic acids, such as acetic acid and citric acid, are widely utilized as preservatives, flavoring agents, and acidulants. The growing consumer preference for natural and organic food products is likely to drive the demand for these acids, as they are often perceived as safer alternatives to synthetic additives. In 2023, the food and beverage segment accounted for approximately 30% of the total carboxylic acid consumption, indicating a robust market presence. As health-conscious consumers continue to seek products with fewer artificial ingredients, the carboxylic acid market is poised for further growth in this sector.

Industrial Growth and Chemical Manufacturing

The Carboxylic Acid Market is significantly impacted by the growth of industrial applications and chemical manufacturing. Carboxylic acids are essential raw materials in the production of various chemicals, including polymers, solvents, and surfactants. The increasing industrialization and the demand for high-performance materials are likely to drive the consumption of carboxylic acids. In 2023, the industrial segment represented approximately 40% of the total carboxylic acid consumption, underscoring its importance in the market. As industries continue to evolve and seek innovative solutions, the carboxylic acid market is expected to benefit from this upward trend, suggesting a robust future.

Environmental Regulations and Sustainability Initiatives

The Carboxylic Acid Market is influenced by the growing emphasis on environmental regulations and sustainability initiatives. Governments and organizations are increasingly advocating for the use of biodegradable and eco-friendly chemicals, which positions carboxylic acids favorably due to their natural origins and lower environmental impact. The shift towards sustainable practices in various industries, including agriculture and manufacturing, is likely to enhance the demand for carboxylic acids. In 2023, the sustainability-focused segment accounted for around 15% of the total carboxylic acid consumption, indicating a rising trend. As industries adapt to these regulations, the carboxylic acid market may see a significant boost, reflecting a commitment to environmental stewardship.