Expansion of Legalization

The ongoing expansion of cannabis legalization across various regions is a significant catalyst for the Cannabis Testing Services Market. As more jurisdictions legalize cannabis for medical and recreational use, the need for reliable testing services becomes paramount. Legalization often comes with regulatory frameworks that mandate testing for safety and quality assurance, thereby creating a robust demand for testing laboratories. This trend is expected to continue, with several countries and states considering or implementing legalization measures. The increase in legal cannabis sales is projected to reach billions of dollars, further propelling the need for comprehensive testing services to ensure compliance with regulatory standards. Consequently, the cannabis testing services market is likely to witness substantial growth as new markets emerge.

Consumer Awareness and Product Safety

The growing awareness among consumers regarding product safety is a pivotal driver for the Cannabis Testing Services Market. As more individuals seek information about the quality and safety of cannabis products, the demand for transparent testing services is increasing. Consumers are becoming more discerning, often looking for third-party lab results to verify the potency and purity of the products they purchase. This trend is particularly evident in markets where cannabis has been legalized for recreational or medicinal use. The emphasis on product safety not only fosters consumer trust but also compels manufacturers to prioritize testing, thereby driving the overall market for cannabis testing services. It is estimated that consumer demand for tested products could lead to a market growth rate of approximately 15% over the next few years.

Technological Advancements in Testing

Technological innovations are reshaping the Cannabis Testing Services Market, leading to more efficient and accurate testing methods. Advanced analytical techniques, such as high-performance liquid chromatography and mass spectrometry, are becoming increasingly prevalent in laboratories. These technologies enable precise quantification of cannabinoids and detection of harmful substances, thereby improving the reliability of test results. Furthermore, automation in testing processes is reducing turnaround times, allowing for quicker product release to the market. As the industry evolves, the integration of artificial intelligence and machine learning in data analysis is anticipated to enhance testing capabilities further. This technological evolution is likely to attract more businesses to invest in cannabis testing services, thereby expanding the market.

Regulatory Compliance and Quality Assurance

The Cannabis Testing Services Market is experiencing a surge in demand due to increasing regulatory compliance requirements. Governments are implementing stringent regulations to ensure product safety and quality, which necessitates comprehensive testing services. In many regions, cannabis products must undergo rigorous testing for contaminants, potency, and labeling accuracy. This regulatory landscape drives the need for certified laboratories that can provide reliable testing results. As a result, the market for cannabis testing services is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. The emphasis on quality assurance not only protects consumers but also enhances the credibility of the cannabis industry as a whole.

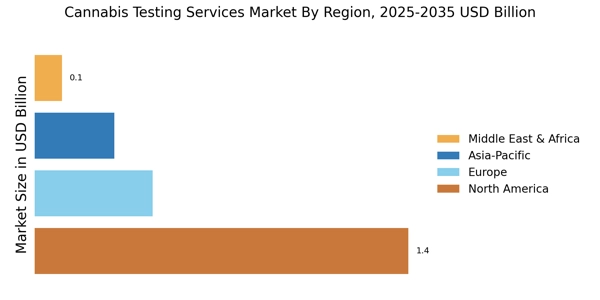

Emerging Markets and Investment Opportunities

Emerging markets present a wealth of investment opportunities within the Cannabis Testing Services Market. As cannabis becomes more accepted globally, countries that are in the early stages of legalization are beginning to establish their regulatory frameworks. This creates a demand for testing services that can meet the specific needs of these new markets. Investors are increasingly recognizing the potential for growth in these regions, leading to a surge in funding for cannabis testing laboratories. The establishment of testing facilities in emerging markets not only supports local economies but also ensures that products meet international safety standards. As these markets develop, the cannabis testing services sector is expected to expand, potentially leading to a market valuation in the billions.