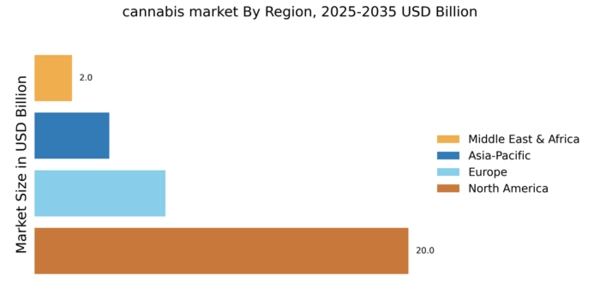

North America : Market Leader in Cannabis

North America continues to lead The cannabis (marijuana) market, holding a significant share of 20.0 in 2025. The region's growth is driven by increasing legalization, evolving consumer preferences, and a robust supply chain. Regulatory frameworks in states like California and Colorado have catalyzed market expansion, fostering a competitive environment that attracts investment and innovation. The United States is the primary market within North America, with key players such as Curaleaf Holdings Inc., Trulieve Cannabis Corp., and Green Thumb Industries Inc. dominating the landscape. Canada also plays a crucial role, with companies like Canopy Growth Corporation and Aurora Cannabis Inc. contributing to the region's growth. The competitive landscape is characterized by mergers, acquisitions, and strategic partnerships aimed at enhancing market reach and product offerings.

Europe : Emerging Cannabis Market

Europe's cannabis market is rapidly evolving, with a market size of 7.0 in 2025. The region is witnessing increased demand for medical cannabis, driven by changing regulations and growing acceptance among healthcare professionals. Countries like Germany and the Netherlands are at the forefront, implementing progressive policies that facilitate market entry and expansion for cannabis companies. Germany stands out as a leader in the European market, with a well-established framework for medical cannabis. The competitive landscape includes both local and international players, with companies like Tilray Brands Inc. making significant inroads. The European market is characterized by a mix of established firms and emerging startups, all vying for a share of this burgeoning sector. "The German government is committed to ensuring a safe and regulated cannabis market for medical use," Bundesopiumstelle, Germany's Federal Institute for Drugs and Medical Devices.

Asia-Pacific : Growing Interest in Cannabis

The Asia-Pacific cannabis market is gaining traction, with a market size of 4.0 in 2025. This growth is fueled by increasing interest in medical cannabis and changing perceptions among consumers and policymakers. Countries like Australia and New Zealand are leading the way, implementing regulations that support the cultivation and distribution of cannabis products for medical use. Australia is a key player in the region, with a regulatory framework that allows for both medical and research purposes. The competitive landscape is still developing, with a mix of local startups and international companies exploring opportunities. As regulations continue to evolve, the market is expected to expand, attracting investment and innovation. The region's potential is significant, with a growing number of stakeholders entering the market.

Middle East and Africa : Emerging Cannabis Opportunities

The Middle East and Africa cannabis market is in its nascent stages, with a market size of 2.0 in 2025. The region is beginning to explore cannabis for both medical and industrial applications, driven by changing regulations and increasing awareness of its benefits. Countries like South Africa are leading the charge, implementing policies that allow for the legal use of cannabis for medical purposes. South Africa's progressive stance on cannabis has opened doors for local and international companies to enter the market. The competitive landscape is still forming, with a focus on education and advocacy to promote the benefits of cannabis. As regulations continue to evolve, the region is poised for growth, attracting interest from investors and entrepreneurs looking to capitalize on emerging opportunities.