Growing Patient Demand

The medical cannabis market is experiencing a notable increase in patient demand, driven by a growing recognition of its therapeutic benefits. Conditions such as chronic pain, epilepsy, and multiple sclerosis have led to a surge in prescriptions. Recent data indicates that approximately 3 million patients in the US are currently utilizing medical cannabis, reflecting a growth rate of around 20% annually. This rising patient base is likely to propel the medical cannabis market forward, as more individuals seek alternative treatments. Furthermore, the increasing awareness of cannabis as a viable option for symptom management is fostering a more favorable environment for the industry. As healthcare providers become more educated about the benefits of medical cannabis, the market is expected to expand, potentially leading to new product developments and innovations tailored to patient needs.

Public Awareness and Education

Public awareness and education regarding the medical cannabis market are crucial for its growth. As more information becomes available about the benefits and uses of medical cannabis, public perception is shifting positively. Educational campaigns by advocacy groups and healthcare professionals are helping to dispel myths and misconceptions surrounding cannabis use. This increased understanding is likely to lead to higher acceptance among patients and healthcare providers alike. In 2025, surveys indicate that approximately 70% of the population supports the use of medical cannabis, reflecting a significant change in attitudes. As public awareness continues to grow, the medical cannabis market may see an influx of new patients seeking treatment options, thereby driving demand and expanding the market further.

Increased Investment and Funding

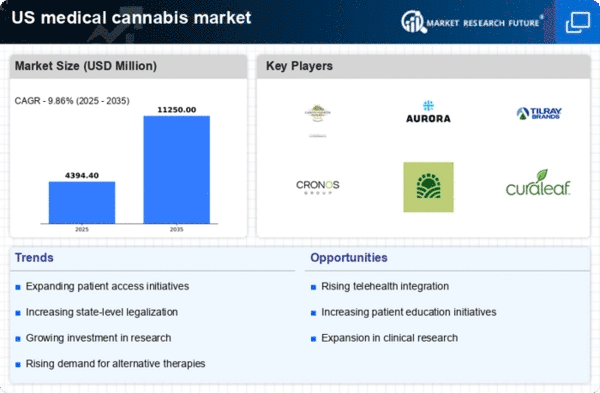

Investment in the medical cannabis market is on the rise, as venture capitalists and institutional investors recognize the potential for substantial returns. In 2025, the market is projected to reach a valuation of $30 billion, attracting significant financial interest. This influx of capital is likely to support research, product development, and marketing efforts within the industry. Furthermore, the establishment of partnerships between cannabis companies and pharmaceutical firms may enhance credibility and facilitate the development of new therapies. As funding continues to flow into the medical cannabis market, it is expected that innovation will accelerate, leading to a broader range of products and services that cater to diverse patient needs. This trend may also encourage the entry of new players into the market, further stimulating competition and growth.

Regulatory Changes and Frameworks

The evolving regulatory landscape surrounding the medical cannabis market is a critical driver of growth. States are increasingly implementing frameworks that facilitate access to medical cannabis for patients. As of November 2025, over 30 states have legalized medical cannabis, with varying degrees of regulation. This regulatory acceptance is likely to enhance market stability and encourage investment in the industry. Moreover, the establishment of clear guidelines for cultivation, distribution, and sales is expected to attract more businesses to the medical cannabis market. The potential for federal legalization could further amplify this trend, as it may lead to a more unified regulatory approach across the country. Consequently, the medical cannabis market is poised for significant expansion as regulations become more favorable and accessible.

Advancements in Product Development

Innovations in product development are playing a pivotal role in shaping the medical cannabis market. Companies are increasingly focusing on creating a diverse range of products, including oils, edibles, and topicals, to cater to varying patient preferences. The introduction of standardized dosing and formulations is likely to enhance patient safety and efficacy, making medical cannabis more appealing to a broader audience. Additionally, advancements in extraction and cultivation techniques are expected to improve product quality and consistency. As the medical cannabis market evolves, the emphasis on research and development will likely lead to the emergence of novel therapies and delivery methods. This focus on innovation may not only attract new consumers but also solidify the market's position within the healthcare landscape.