Expansion of Cloud Infrastructure

the software as-a-service market in Canada. is benefiting from the ongoing expansion of cloud infrastructure. As cloud service providers enhance their offerings and capabilities, businesses are increasingly migrating to cloud-based solutions. In 2025, it is estimated that over 60% of Canadian enterprises will have adopted cloud infrastructure, facilitating the growth of the software as-a-service market. This transition allows organizations to leverage scalable and flexible solutions that can adapt to their evolving needs. Additionally, advancements in cloud technology, such as improved security measures and enhanced performance, further encourage businesses to embrace software as-a-service models. The expansion of cloud infrastructure not only supports the current demand for software solutions but also lays the groundwork for future innovations within the software as-a-service market.

Increased Focus on Data Analytics

the software as-a-service market in Canada. is witnessing a significant increase in the focus on data analytics solutions. Businesses are increasingly recognizing the value of data-driven decision-making, leading to a growing demand for analytics tools that can be accessed via the cloud. In 2025, it is projected that the analytics segment within the software as-a-service market will account for over 25% of total market revenue. This trend is fueled by the need for organizations to derive actionable insights from vast amounts of data, enabling them to enhance operational efficiency and customer engagement. Moreover, the integration of advanced analytics capabilities, such as predictive modeling and machine learning, further enriches the offerings within the software as-a-service market, positioning it as a critical component for businesses aiming to remain competitive in a data-centric landscape.

Emergence of Industry-Specific Solutions

the software as-a-service market in Canada. is witnessing the emergence of industry-specific solutions tailored to meet the unique needs of various sectors. As businesses seek to optimize their operations, there is a growing demand for software that addresses specific industry challenges. In 2025, it is projected that industry-specific software offerings will account for a significant share of the software as-a-service market. This trend is particularly evident in sectors such as retail, healthcare, and manufacturing, where specialized solutions can enhance efficiency and drive growth. By providing targeted functionalities and features, these industry-specific solutions enable organizations to streamline processes and improve overall performance. The emergence of such tailored offerings is likely to reshape the software as-a-service market, as businesses increasingly prioritize solutions that align with their operational requirements.

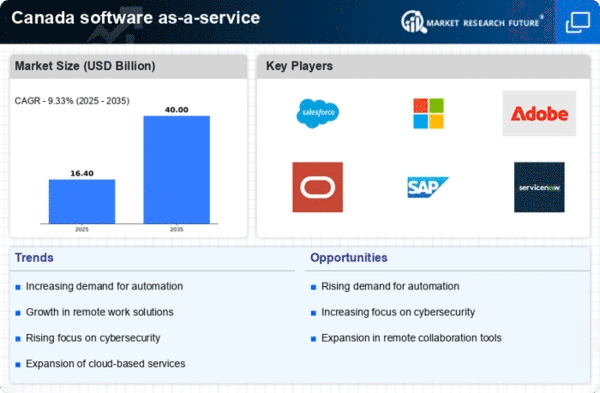

Growing Demand for Remote Work Solutions

The software as-a-service market in Canada experiences a notable surge in demand for remote work solutions. As organizations increasingly adopt flexible work arrangements, the need for cloud-based collaboration tools becomes paramount. In 2025, it is estimated that approximately 70% of Canadian businesses utilize some form of remote work software, driving the growth of the software as-a-service market. This shift not only enhances productivity but also fosters a culture of innovation, as teams can collaborate seamlessly from various locations. Furthermore, the convenience of subscription-based models allows companies to scale their software usage according to their needs, making it an attractive option for businesses of all sizes. The ongoing evolution of remote work dynamics suggests that this trend will continue to bolster the software as-a-service market in Canada...... for the foreseeable future.

Rising Importance of Compliance and Regulatory Standards

the software as-a-service market in Canada. is increasingly influenced by the rising importance of compliance and regulatory standards. As businesses navigate complex regulatory environments, the demand for software solutions that ensure compliance with data protection laws and industry regulations is on the rise. In 2025, it is anticipated that compliance-related software offerings will represent a substantial portion of the software as-a-service market. This trend is particularly relevant in sectors such as finance and healthcare, where adherence to regulations is paramount. Consequently, software providers are focusing on developing solutions that not only meet compliance requirements but also enhance security and data integrity. This growing emphasis on compliance is likely to shape the software as-a-service market, as organizations prioritize risk management and regulatory adherence in their software procurement strategies.