Cost Efficiency in Software Testing

Cost efficiency remains a critical driver for the service virtualization market in Canada. Organizations are increasingly recognizing the financial benefits of implementing service virtualization in their testing environments. By simulating services, companies can reduce the need for extensive physical infrastructure, leading to lower operational costs. A recent analysis suggests that businesses can save up to 30% on testing expenses by utilizing service virtualization tools. This cost reduction is particularly appealing to Canadian enterprises looking to optimize their budgets while maintaining high-quality software delivery. As companies strive to enhance their return on investment, This market is likely to see continued growth as a viable solution for cost-effective software testing..

Enhanced Collaboration Across Teams

Enhanced collaboration across development and testing teams is a significant driver for the service virtualization market in Canada. As organizations strive for improved communication and teamwork, service virtualization tools facilitate better collaboration by providing a shared environment for testing and development. This collaborative approach allows teams to work concurrently, reducing bottlenecks and accelerating project timelines. Recent surveys indicate that companies utilizing service virtualization report a 25% improvement in team collaboration and efficiency. As Canadian enterprises continue to prioritize collaborative practices, the service virtualization market is likely to benefit from this trend, fostering an environment conducive to innovation and rapid software delivery.

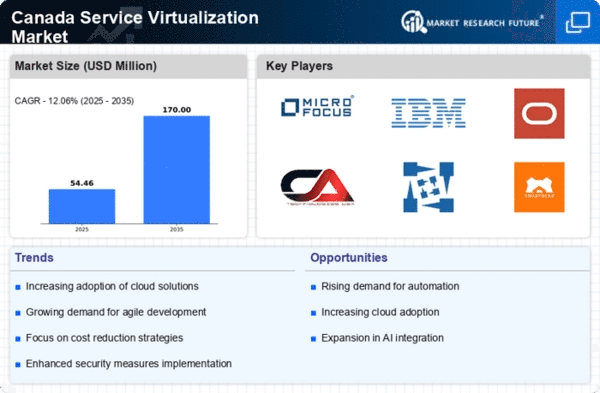

Growing Demand for Agile Development

This market in Canada is experiencing a notable surge in demand driven by the need for agile development methodologies.. Organizations are increasingly adopting agile practices to enhance their software development processes, which necessitates the use of service virtualization tools. These tools allow teams to simulate services and components, enabling faster testing and integration. According to recent data, the Canadian software development sector is projected to grow at a CAGR of 8.5% through 2026, indicating a robust environment for service virtualization solutions. This growth is likely to be fueled by the desire for quicker time-to-market and improved collaboration among development teams, thereby propelling the service virtualization market forward.

Integration with Emerging Technologies

The integration of emerging technologies is a pivotal driver for the service virtualization market in Canada. As organizations explore the potential of artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), the need for effective testing and development environments becomes paramount. Service virtualization enables seamless integration with these technologies, allowing for the simulation of complex interactions and data flows. This capability is essential for Canadian businesses aiming to innovate and remain competitive in a rapidly evolving digital landscape. The service virtualization market is poised for growth as companies increasingly seek solutions that can accommodate the complexities introduced by emerging technologies, thereby enhancing their development processes.

Regulatory Compliance and Risk Management

In the context of the service virtualization market, regulatory compliance and risk management are becoming increasingly significant drivers in Canada. As industries such as finance and healthcare face stringent regulations, organizations are compelled to adopt solutions that ensure compliance while minimizing risks. Service virtualization tools facilitate the creation of secure testing environments that adhere to regulatory standards. This capability is particularly crucial for Canadian companies that must navigate complex compliance landscapes. The demand for such solutions is expected to rise, as organizations prioritize risk management strategies, thereby bolstering the service virtualization market. The ability to conduct thorough testing without compromising sensitive data is likely to enhance the appeal of these tools.