Rising Popularity of Motorcycles

The increasing popularity of motorcycles in Canada is a pivotal driver for the motorcycle insurance market. As more individuals opt for motorcycles as a primary mode of transportation, the demand for insurance coverage rises correspondingly. In 2025, motorcycle registrations in Canada have shown a growth of approximately 5% compared to previous years, indicating a robust interest in two-wheeled vehicles. This trend is particularly pronounced among younger demographics, who are drawn to the affordability and convenience of motorcycles. Consequently, insurance providers are adapting their offerings to cater to this expanding customer base, leading to a more competitive motorcycle insurance market. The influx of new riders necessitates tailored insurance solutions, further stimulating market growth and innovation in policy design.

Legislative Changes and Regulations

Legislative changes and evolving regulations play a crucial role in shaping the motorcycle insurance market. In Canada, recent amendments to traffic laws and insurance requirements have prompted riders to seek comprehensive coverage options. For instance, mandatory liability insurance has become a standard requirement, compelling all motorcycle owners to secure appropriate policies. This regulatory environment not only enhances road safety but also drives demand for insurance products that comply with new legal standards. As a result, insurance companies are likely to expand their offerings to include additional coverage options, such as collision and comprehensive insurance, thereby fostering growth within the motorcycle insurance market. The ongoing adjustments in legislation may also lead to increased awareness among riders regarding the importance of adequate insurance coverage.

Increased Awareness of Safety Measures

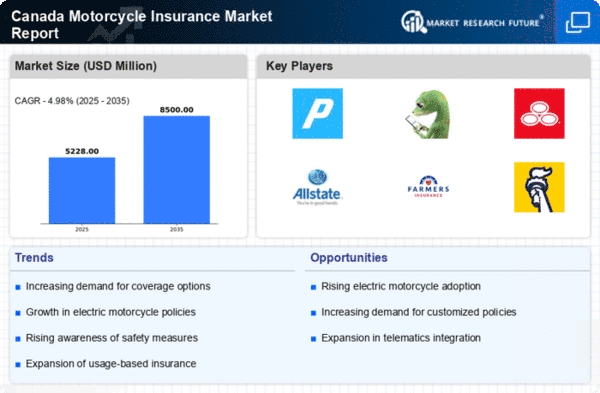

The heightened awareness of safety measures among motorcycle riders is a significant driver for the motorcycle insurance market. As safety campaigns and educational programs proliferate, riders are becoming more conscious of the risks associated with motorcycling. This awareness has led to a demand for insurance policies that offer enhanced coverage for safety-related incidents. In 2025, it is projected that around 40% of new policies will include additional safety features, such as roadside assistance and accident forgiveness. Insurers are responding to this trend by developing specialized products that cater to safety-conscious riders, thereby expanding their market share. The focus on safety not only promotes responsible riding but also encourages riders to invest in comprehensive insurance coverage, further propelling the growth of the motorcycle insurance market.

Technological Advancements in Insurance

Technological advancements are significantly influencing the motorcycle insurance market in Canada. The integration of digital platforms and mobile applications has transformed how consumers interact with insurance providers. Riders can now easily compare policies, obtain quotes, and manage their insurance online, enhancing customer experience. Moreover, the use of data analytics allows insurers to assess risk more accurately, leading to personalized premium pricing. In 2025, it is estimated that approximately 30% of motorcycle insurance policies are purchased online, reflecting a shift towards digitalization. This trend not only streamlines the purchasing process but also encourages competition among insurers, ultimately benefiting consumers. As technology continues to evolve, the motorcycle insurance market is likely to witness further innovations that enhance service delivery and customer engagement.

Economic Factors Influencing Insurance Costs

Economic factors are a critical driver impacting the motorcycle insurance market in Canada. Fluctuations in the economy, such as changes in disposable income and unemployment rates, can directly influence consumers' ability to purchase insurance. In 2025, the Canadian economy is experiencing moderate growth, which may lead to increased disposable income for many individuals. This economic environment could result in a higher demand for motorcycle insurance as more people are willing to invest in recreational activities, including motorcycling. Additionally, insurers may adjust their pricing strategies based on economic conditions, potentially leading to more competitive rates. As the economy continues to evolve, the motorcycle insurance market is likely to adapt, reflecting the changing financial landscape and consumer behavior.