Enhanced Collaboration Among Agencies

Collaboration among various agencies is becoming increasingly vital in the incident emergency-management market. In Canada, federal, provincial, and municipal governments are recognizing the need for a coordinated approach to emergency management. This collaboration is facilitated through joint training exercises, shared resources, and integrated communication systems. The establishment of frameworks that promote inter-agency cooperation is likely to enhance the overall effectiveness of emergency response efforts. As agencies work together more closely, the incident emergency-management market is expected to benefit from improved resource allocation and streamlined operations, ultimately leading to better outcomes during emergencies.

Rising Public Expectations for Safety

Public expectations regarding safety and emergency preparedness are on the rise in Canada, significantly impacting the incident emergency-management market. Citizens are increasingly demanding transparency and accountability from their governments in terms of emergency response capabilities. This shift in public sentiment is prompting authorities to invest more in training, resources, and community engagement initiatives. Surveys indicate that over 70% of Canadians believe that their local governments should prioritize emergency preparedness. As a result, the incident emergency-management market is likely to see a growing emphasis on public education campaigns and community involvement, fostering a culture of preparedness and resilience.

Increased Investment in Emergency Services

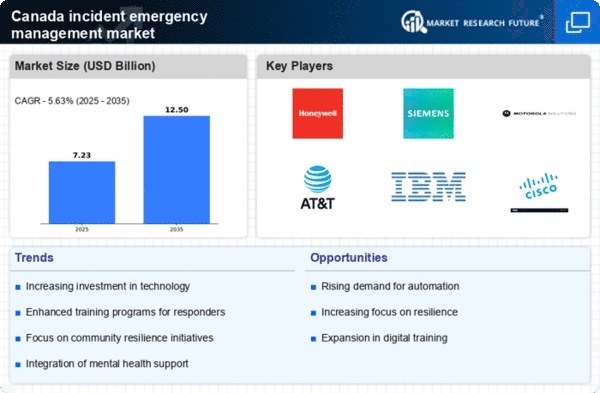

The incident emergency-management market in Canada is experiencing a notable surge in investment from both public and private sectors. Government funding for emergency services has increased by approximately 15% over the past three years, reflecting a commitment to enhancing preparedness and response capabilities. This influx of capital is directed towards upgrading infrastructure, acquiring advanced technology, and training personnel. As municipalities and provinces recognize the importance of effective emergency management, they are allocating more resources to ensure that their emergency services are equipped to handle various incidents. This trend is likely to continue, as the demand for efficient incident management solutions grows, thereby driving the market forward.

Growing Awareness of Climate Change Impacts

The incident emergency-management market is significantly influenced by the increasing awareness of climate change and its associated risks. In Canada, extreme weather events such as floods, wildfires, and storms have become more frequent, prompting a reevaluation of emergency preparedness strategies. According to Environment and Climate Change Canada, the frequency of severe weather events has risen by 30% in the last decade. This heightened awareness is leading to a greater emphasis on developing robust emergency management frameworks that can effectively address climate-related incidents. Consequently, stakeholders in the incident emergency-management market are focusing on innovative solutions to mitigate risks and enhance community resilience.

Technological Advancements in Emergency Response

Technological advancements are reshaping the incident emergency-management market in Canada. The integration of cutting-edge technologies such as artificial intelligence, drones, and real-time data analytics is enhancing the efficiency and effectiveness of emergency response efforts. For instance, the use of drones for aerial surveillance during disasters has proven invaluable, allowing for quicker assessments and resource allocation. Furthermore, the market is projected to grow by 20% over the next five years, driven by the demand for innovative solutions that improve situational awareness and decision-making processes. As technology continues to evolve, it is expected to play a pivotal role in transforming how emergency incidents are managed.