Integration of Cloud Technologies

The integration of cloud technologies is significantly influencing the enterprise high-productivity-application-platform-service market in Canada. As organizations increasingly migrate to cloud-based solutions, the demand for platforms that support cloud integration is on the rise. This shift allows for greater scalability, accessibility, and collaboration among teams, which are essential for modern application development. Data indicates that over 60% of Canadian enterprises are adopting cloud-based application platforms to enhance their operational capabilities. This trend suggests that the enterprise high-productivity-application-platform-service market will continue to evolve, driven by the need for solutions that seamlessly integrate with cloud infrastructures, thereby enabling businesses to leverage the full potential of cloud computing.

Increased Focus on Employee Productivity

In the enterprise high-productivity-application-platform-service market, there is a marked emphasis on enhancing employee productivity. Organizations in Canada are recognizing that efficient application development platforms can streamline workflows and improve collaboration among teams. This focus on productivity is reflected in the increasing investments in tools that enable employees to create applications with minimal coding expertise. A recent survey indicated that 70% of Canadian enterprises are prioritizing investments in high-productivity application platforms to empower their workforce. This trend suggests that the enterprise high-productivity-application-platform-service market will continue to expand as companies seek to leverage technology to enhance operational efficiency and drive business outcomes.

Emphasis on Cost Efficiency in IT Operations

Cost efficiency remains a pivotal driver in the enterprise high-productivity-application-platform-service market. Canadian organizations are increasingly focused on optimizing their IT budgets while maintaining high-quality application development. The ability to reduce development costs through the use of high-productivity platforms is appealing to many businesses. Recent studies suggest that companies utilizing these platforms can achieve up to a 30% reduction in development costs compared to traditional methods. This emphasis on cost efficiency is likely to drive further adoption of high-productivity application platforms, as organizations seek to maximize their return on investment in technology. Consequently, the enterprise high-productivity-application-platform-service market is expected to thrive as businesses prioritize cost-effective solutions.

Rising Need for Customization and Flexibility

The enterprise high-productivity-application-platform-service market is witnessing a rising need for customization and flexibility in application development. Canadian businesses are increasingly looking for solutions that allow them to tailor applications to their specific requirements without extensive coding. This demand for customization is driven by the diverse needs of various industries, including finance, healthcare, and retail. As organizations strive to differentiate themselves in competitive markets, the ability to quickly adapt applications to meet unique business needs becomes crucial. Market analysis indicates that the customization capabilities of high-productivity application platforms are a key factor influencing purchasing decisions, thereby propelling growth in the enterprise high-productivity-application-platform-service market.

Growing Demand for Rapid Application Development

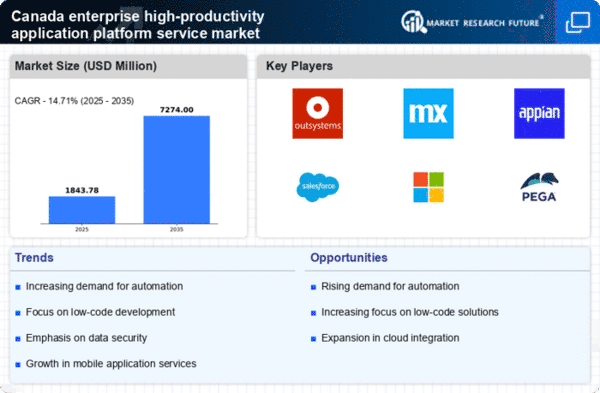

The enterprise high-productivity-application-platform-service market in Canada is experiencing a notable surge in demand for rapid application development. Organizations are increasingly seeking to accelerate their digital transformation initiatives, which necessitates the swift creation of applications. This trend is driven by the need for businesses to respond quickly to market changes and customer demands. According to recent data, the Canadian market for application development tools is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of a broader shift towards agile methodologies and the adoption of platforms that facilitate faster development cycles. As a result, the enterprise high-productivity-application-platform-service market is positioned to benefit significantly from this growing demand, as companies prioritize speed and efficiency in their application development processes.