Shift Towards Automation

The ems odm market is witnessing a significant shift towards automation, which is reshaping production processes and operational efficiencies. Canadian manufacturers are increasingly adopting automated systems to streamline their operations, reduce labor costs, and enhance product quality. This trend is particularly evident in the electronics sector, where automation technologies are being integrated into assembly lines and quality control processes. The adoption of automation is projected to increase productivity by approximately 15% in the coming years, thereby allowing companies to respond more swiftly to market demands. As automation becomes more prevalent, the ems odm market is likely to experience a transformation in its operational landscape, leading to improved efficiency and reduced time-to-market for new products.

Rising Demand for Electronics

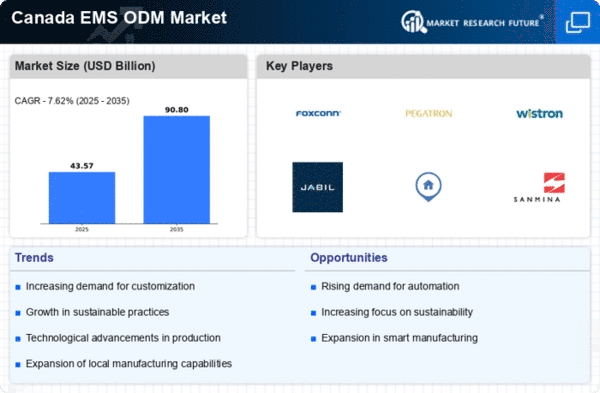

The ems odm market in Canada is experiencing a notable surge in demand for electronic devices, driven by the increasing reliance on technology across various sectors. As consumers and businesses alike seek advanced electronic solutions, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. This growth is largely attributed to the proliferation of smart devices, IoT applications, and automation technologies. Consequently, manufacturers in the ems odm market are compelled to enhance their production capabilities and innovate their offerings to meet the evolving needs of consumers. The heightened demand for electronics not only stimulates competition among manufacturers but also encourages investment in research and development, thereby fostering a dynamic environment within the ems odm market.

Emergence of Smart Manufacturing

The market is increasingly influenced by the emergence of smart manufacturing practices, which leverage advanced technologies such as AI, machine learning, and data analytics. Canadian manufacturers are adopting these technologies to optimize production processes, enhance product quality, and reduce waste. The integration of smart manufacturing solutions is expected to lead to a 25% increase in operational efficiency within the ems odm market over the next few years. This transformation not only improves productivity but also enables companies to offer more customized solutions to their clients. As smart manufacturing continues to gain traction, the ems odm market is likely to evolve, fostering innovation and driving competitive advantage among manufacturers.

Focus on Supply Chain Resilience

In the context of the ems odm market, the emphasis on supply chain resilience has become increasingly pronounced. Canadian manufacturers are recognizing the importance of establishing robust supply chains to mitigate risks associated with disruptions. This focus is driven by the need to ensure consistent product availability and maintain customer satisfaction. Companies are investing in diversifying their supplier base and enhancing logistics capabilities to create more resilient supply chains. According to recent studies, organizations that prioritize supply chain resilience can achieve up to a 20% reduction in operational costs. As a result, the ems odm market is likely to benefit from improved supply chain strategies, which will enhance overall competitiveness and responsiveness to market fluctuations.

Government Support and Incentives

Government initiatives in Canada are playing a pivotal role in bolstering the ems odm market. Various programs and incentives aimed at promoting technological innovation and manufacturing efficiency are being implemented. For instance, the Canadian government has allocated over $1 billion in funding to support advanced manufacturing initiatives, which directly benefits the ems odm market. This financial backing encourages companies to invest in state-of-the-art technologies and processes, enhancing their competitiveness. Furthermore, tax incentives for research and development activities are likely to stimulate innovation within the ems odm market, allowing firms to develop cutting-edge products that cater to the growing consumer demand. As a result, the supportive regulatory environment is expected to drive growth and sustainability in the ems odm market.