Rising IoT Adoption

The proliferation of Internet of Things (IoT) devices in Canada is a key driver for the edge data-center market. As more devices connect to the internet, the demand for real-time data processing increases. This trend necessitates localized data centers to minimize latency and enhance performance. In 2025, it is estimated that the number of connected IoT devices in Canada will exceed 1 billion, creating a substantial need for edge computing solutions. The edge data-center market is poised to benefit from this surge, as businesses seek to leverage IoT for operational efficiency and innovation. Furthermore, the integration of IoT with edge computing can lead to improved data analytics and decision-making capabilities, further propelling market growth.

Expansion of 5G Networks

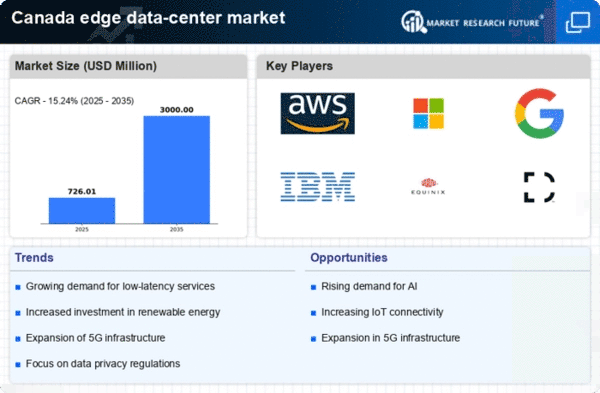

The rollout of 5G networks across Canada is significantly impacting the edge data-center market. With 5G technology offering higher speeds and lower latency, the demand for edge computing solutions is expected to rise. By 2025, it is projected that 5G subscriptions in Canada will reach approximately 20 million, driving the need for localized data processing. This expansion allows businesses to harness the full potential of 5G, enabling applications such as augmented reality, autonomous vehicles, and smart cities. The edge data-center market stands to gain from this technological advancement, as it facilitates the deployment of applications that require immediate data processing and response times.

Increased Data Privacy Regulations

The tightening of data privacy regulations in Canada is influencing the edge data-center market. As organizations strive to comply with laws such as the Personal Information Protection and Electronic Documents Act (PIPEDA), there is a growing emphasis on data sovereignty. This trend encourages businesses to utilize edge data centers to ensure that sensitive data remains within Canadian borders. By 2025, it is anticipated that compliance costs for organizations could rise by up to 30%, prompting a shift towards localized data solutions. The edge data-center market is likely to see increased investment as companies prioritize data security and regulatory compliance, thereby driving demand for edge computing infrastructure.

Demand for Enhanced Security Solutions

The rising threat of cyberattacks in Canada is a critical driver for the edge data-center market. As organizations increasingly rely on digital infrastructure, the need for robust security measures becomes paramount. Edge data centers can provide enhanced security by processing data closer to the source, reducing the risk of data breaches. In 2025, it is estimated that cybercrime costs could reach $6 trillion globally, prompting Canadian businesses to invest in more secure data solutions. The edge data-center market is well-positioned to address these security concerns, offering solutions that integrate advanced security protocols and real-time monitoring to protect sensitive information.

Growth of Remote Work and Digital Transformation

The shift towards remote work and digital transformation in Canada is driving the edge data-center market. As businesses adapt to new operational models, there is an increasing reliance on cloud services and edge computing to support remote access and collaboration. By 2025, it is projected that remote work will account for 30% of the Canadian workforce, necessitating scalable and efficient data solutions. The edge data-center market is likely to experience growth as organizations seek to enhance their digital infrastructure, ensuring seamless connectivity and performance for remote employees. This trend underscores the importance of localized data processing to meet the demands of a distributed workforce.