Rising Cybersecurity Threats

The byod security market in Canada is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats. Organizations are recognizing the necessity of robust security measures to protect sensitive data accessed through personal devices. In 2025, it is estimated that cybercrime could cost Canadian businesses over $10 billion annually, prompting a shift towards comprehensive security solutions. This trend indicates that companies are investing in advanced security protocols, including encryption and multi-factor authentication, to mitigate risks associated with BYOD policies. As employees utilize personal devices for work-related tasks, the potential for data breaches escalates, thereby driving the need for enhanced security measures within the byod security market. Consequently, businesses are prioritizing investments in security technologies to safeguard their networks and maintain compliance with evolving regulations.

Increased Remote Work Adoption

The byod security market is significantly influenced by the growing trend of remote work in Canada. As organizations embrace flexible work arrangements, employees increasingly access corporate resources from personal devices. This shift necessitates the implementation of stringent security measures to protect sensitive information. According to recent statistics, approximately 30% of Canadian employees work remotely, a figure that is projected to rise. This trend compels organizations to adopt comprehensive security frameworks that address the unique challenges posed by remote access. The demand for solutions such as mobile device management (MDM) and virtual private networks (VPNs) is likely to surge as companies seek to secure their data while accommodating the needs of a remote workforce. Thus, the byod security market is poised for growth as businesses adapt to this evolving work landscape.

Growing Awareness of Data Privacy

In Canada, there is a marked increase in awareness regarding data privacy among consumers and organizations alike, which is significantly impacting the byod security market. With the implementation of stringent data protection regulations, such as the Personal Information Protection and Electronic Documents Act (PIPEDA), businesses are compelled to prioritize data security. This heightened awareness is driving organizations to invest in security solutions that ensure compliance and protect user data. Surveys indicate that over 70% of Canadians express concern about their personal information being compromised, leading to a demand for robust security measures. As a result, companies are increasingly adopting security frameworks that address these concerns, thereby propelling growth in the byod security market. This trend suggests that organizations are not only focusing on compliance but also on building trust with their customers through enhanced data protection.

Shift Towards Cloud-Based Security Solutions

The byod security market is witnessing a notable shift towards cloud-based security solutions in Canada. As organizations increasingly migrate their operations to the cloud, the need for scalable and flexible security measures becomes paramount. Cloud security solutions offer the advantage of centralized management and real-time updates, which are essential for protecting data accessed through personal devices. Recent data suggests that the cloud security market in Canada is projected to grow by 25% annually, reflecting the increasing adoption of cloud technologies. This trend indicates that businesses are recognizing the importance of integrating cloud security into their overall security strategies. Consequently, the byod security market is likely to expand as organizations seek to leverage cloud-based solutions to enhance their security posture while accommodating the demands of a mobile workforce.

Technological Advancements in Security Solutions

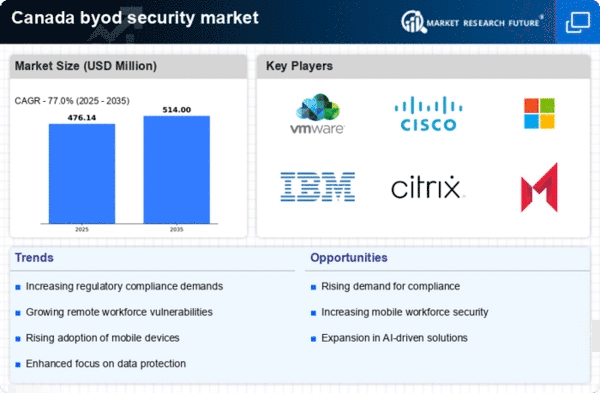

The byod security market in Canada is being propelled by rapid technological advancements in security solutions. Innovations such as artificial intelligence (AI) and machine learning (ML) are transforming the landscape of cybersecurity, enabling organizations to detect and respond to threats more effectively. In 2025, it is projected that the market for AI-driven security solutions could reach $5 billion in Canada, reflecting a growing reliance on technology to enhance security measures. These advancements allow for real-time monitoring and automated threat detection, which are crucial for organizations implementing BYOD policies. As businesses increasingly adopt these technologies, the demand for sophisticated security solutions within the byod security market is expected to rise. This trend indicates a shift towards proactive security measures that can adapt to the evolving threat landscape.