Rising Cyber Threats

The botnet detection market in Canada is experiencing growth due to the increasing frequency and sophistication of cyber threats. Cybercriminals are leveraging botnets to execute Distributed Denial of Service (DDoS) attacks, which can cripple businesses and disrupt services. In 2025, it is estimated that cybercrime will cost Canadian businesses over $10 billion annually. This alarming trend compels organizations to invest in robust botnet detection solutions to safeguard their digital assets. The urgency to protect sensitive data and maintain operational continuity drives demand for advanced detection technologies. As a result, the botnet detection market is likely to expand as companies seek to mitigate risks associated with these evolving threats.

Technological Advancements

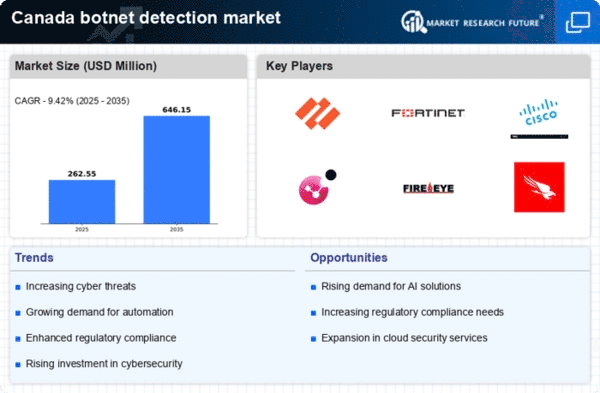

Technological advancements play a pivotal role in shaping the botnet detection market in Canada. Innovations in cybersecurity technologies, such as machine learning and behavioral analytics, enhance the ability to detect and neutralize botnets effectively. In 2025, the market for cybersecurity solutions in Canada is projected to reach $5 billion, with a significant portion allocated to botnet detection systems. These advancements enable organizations to identify anomalies in network traffic and respond swiftly to potential threats. Consequently, the botnet detection market is poised for growth as businesses increasingly adopt cutting-edge technologies to fortify their defenses against cyber threats.

Increased Regulatory Scrutiny

The botnet detection market in Canada is influenced by heightened regulatory scrutiny surrounding data protection and cybersecurity. Regulatory bodies are imposing stricter compliance requirements on organizations to safeguard consumer data. In 2025, it is anticipated that compliance-related expenditures will account for approximately 15% of IT budgets in Canada. This regulatory landscape compels businesses to invest in effective botnet detection solutions to ensure compliance and avoid hefty fines. As organizations strive to meet these regulatory demands, the botnet detection market is likely to witness increased adoption of advanced detection technologies to enhance their security posture.

Shift to Remote Work Environments

The shift to remote work environments has significantly impacted the botnet detection market in Canada. As more employees work from home, the attack surface for cybercriminals has expanded, making organizations more vulnerable to botnet attacks. In 2025, it is estimated that remote work will account for 30% of the Canadian workforce, necessitating enhanced security measures. Companies are increasingly investing in botnet detection solutions to protect their networks and ensure secure remote access. This trend is likely to drive growth in the botnet detection market as organizations seek to adapt to the evolving landscape of work and cybersecurity.

Growing Awareness of Cybersecurity

There is a growing awareness of cybersecurity risks among Canadian businesses, which is driving the botnet detection market. Organizations are increasingly recognizing the potential financial and reputational damage caused by cyberattacks. In 2025, surveys indicate that over 70% of Canadian companies plan to increase their cybersecurity budgets, with a focus on botnet detection solutions. This heightened awareness leads to a proactive approach in addressing vulnerabilities and investing in technologies that can detect and mitigate botnet threats. As a result, the botnet detection market is expected to expand as businesses prioritize cybersecurity in their strategic planning.