Expansion of Internet of Things (IoT) Devices

The proliferation of Internet of Things (IoT) devices is significantly impacting the big data-analytics market in Canada. As more devices become interconnected, the volume of data generated is increasing exponentially. This influx of data presents both challenges and opportunities for organizations looking to extract meaningful insights. In fact, it is estimated that by 2025, there will be over 75 billion IoT devices globally, with a substantial portion of this growth occurring in Canada. The ability to analyze data from these devices enables businesses to enhance customer experiences, streamline operations, and develop new revenue streams. As a result, the big data-analytics market is poised for growth, driven by the need to process and analyze vast amounts of data generated by IoT technologies.

Rising Demand for Data-Driven Decision Making

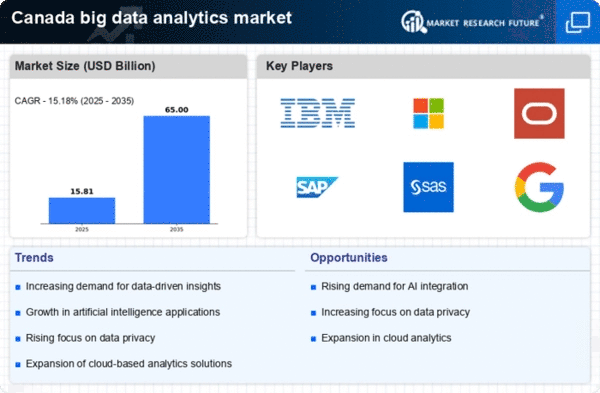

The big data analytics market in Canada is experiencing a notable surge in demand for data-driven decision making across various sectors. Organizations are increasingly recognizing the value of leveraging data analytics to enhance operational efficiency and drive strategic initiatives. According to recent statistics, approximately 70% of Canadian businesses are now utilizing data analytics to inform their decision-making processes. This trend is likely to continue as companies seek to gain a competitive edge in their respective industries. The emphasis on data-driven insights is fostering a culture of innovation, where organizations are more inclined to invest in advanced analytics tools and technologies. Consequently, this rising demand is propelling the growth of the big data-analytics market, as firms strive to harness the power of data to optimize performance and achieve their business objectives.

Government Initiatives Supporting Data Innovation

Government initiatives aimed at fostering data innovation are playing a crucial role in the growth of the big data-analytics market in Canada. Various programs and funding opportunities are being introduced to encourage businesses to adopt data analytics solutions. For instance, the Canadian government has allocated significant resources to support research and development in data science and analytics. This support is likely to stimulate investment in the big data-analytics market, as companies seek to leverage government resources to enhance their analytical capabilities. Furthermore, these initiatives are expected to create a favorable regulatory environment that promotes data sharing and collaboration among organizations, thereby accelerating the adoption of big data analytics across different sectors.

Increased Focus on Customer Experience Enhancement

Enhancing customer experience has become a top priority for businesses in Canada, driving the growth of the big data-analytics market. Organizations are increasingly utilizing data analytics to gain insights into customer behavior, preferences, and trends. By analyzing customer data, companies can tailor their products and services to meet the evolving needs of their clientele. Recent studies indicate that businesses that prioritize customer experience are likely to see a 10-15% increase in customer retention rates. This focus on customer-centric strategies is prompting organizations to invest in advanced analytics tools that can provide actionable insights. Consequently, the big data-analytics market is benefiting from this trend, as companies strive to create personalized experiences that foster customer loyalty.

Emergence of Advanced Analytical Tools and Technologies

The emergence of advanced analytical tools and technologies is significantly shaping the big data-analytics market in Canada. Innovations such as predictive analytics, natural language processing, and machine learning are enabling organizations to analyze complex data sets more effectively. These tools are becoming increasingly accessible to businesses of all sizes, allowing them to harness the power of data analytics without requiring extensive technical expertise. As a result, the adoption of these advanced technologies is expected to grow, with a projected increase of 25% in the use of analytics tools by Canadian companies over the next few years. This trend is likely to drive the expansion of the big data-analytics market, as organizations seek to leverage these technologies to gain deeper insights and improve decision-making processes.