Rising Internet Traffic

The Cable Modem Termination System Market is experiencing a surge in demand due to the increasing volume of internet traffic. As more users connect to the internet for various activities, including streaming, gaming, and remote work, the need for robust cable modem termination systems becomes apparent. According to recent data, internet traffic is projected to grow exponentially, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This growth necessitates the deployment of advanced cable modem termination systems to manage and optimize bandwidth effectively. Consequently, service providers are investing in upgrading their infrastructure to accommodate this rising demand, thereby driving the Cable Modem Termination System Market forward.

Shift Towards Fiber-Optic Networks

The transition from traditional copper networks to fiber-optic technology is significantly influencing the Cable Modem Termination System Market. Fiber-optic networks offer higher bandwidth and faster data transmission rates, which are essential for meeting the demands of modern consumers. As telecommunications companies expand their fiber-optic infrastructure, the integration of cable modem termination systems becomes crucial for managing the increased data flow. Reports indicate that the fiber-optic market is expected to grow at a rate of approximately 15% annually, further propelling the need for efficient cable modem termination systems. This shift not only enhances service quality but also positions providers to compete effectively in an increasingly digital landscape.

Increased Focus on Network Security

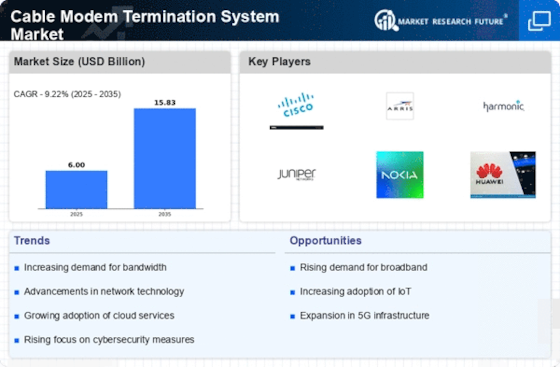

As cyber threats become more sophisticated, the Cable Modem Termination System Market is witnessing a heightened emphasis on network security. Service providers are increasingly aware of the vulnerabilities associated with cable modem systems and are investing in advanced security features to protect their networks. This trend is driven by the need to safeguard user data and maintain service integrity. Market Research Future indicates that The Cable Modem Termination System Market is projected to grow at a rate of 10% annually, which correlates with the rising investments in secure cable modem termination systems. By prioritizing security, service providers not only enhance their offerings but also build consumer trust, thereby fostering growth within the Cable Modem Termination System Market.

Emergence of Smart Homes and IoT Devices

The proliferation of smart home technologies and Internet of Things (IoT) devices is reshaping the Cable Modem Termination System Market. As households adopt smart devices, the demand for reliable and high-speed internet connectivity intensifies. Cable modem termination systems play a pivotal role in ensuring seamless connectivity for these devices, which often require constant internet access. Market analysis suggests that the number of connected devices per household is expected to reach an average of 50 by 2026, creating a substantial need for advanced cable modem termination systems. This trend not only drives sales but also encourages innovation within the industry as manufacturers strive to meet the evolving needs of consumers.

Regulatory Support for Broadband Expansion

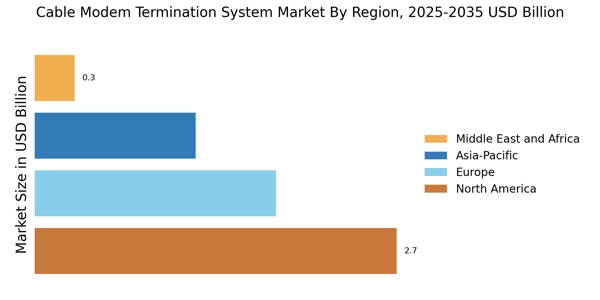

Government initiatives aimed at expanding broadband access are significantly impacting the Cable Modem Termination System Market. Various regulatory bodies are implementing policies to promote high-speed internet access in underserved areas, which in turn drives the demand for cable modem termination systems. For instance, funding programs and incentives for telecommunications companies to enhance their infrastructure are becoming more prevalent. This regulatory support is expected to result in a substantial increase in broadband penetration rates, with projections indicating that by 2027, over 90% of households will have access to high-speed internet. Such developments create a favorable environment for the growth of the Cable Modem Termination System Market.