Growth in Oil and Gas Sector

The Butterfly Valves Market is significantly influenced by the expansion of the oil and gas sector. As exploration and production activities intensify, there is an increasing requirement for reliable flow control solutions. Butterfly valves are favored in this industry due to their ability to handle high-pressure applications and their compact design, which facilitates installation in tight spaces. The oil and gas sector is projected to witness substantial investments, with estimates suggesting a market size of over USD 3 trillion by 2025. This growth is likely to create a robust demand for butterfly valves, particularly in pipeline applications where efficient flow regulation is critical. As such, the Butterfly Valves Market stands to benefit from the ongoing developments in this sector.

Emerging Markets and Economic Development

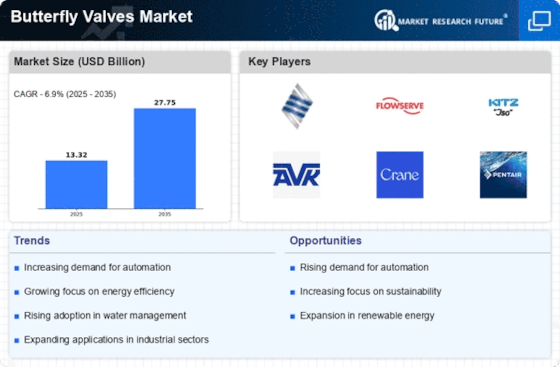

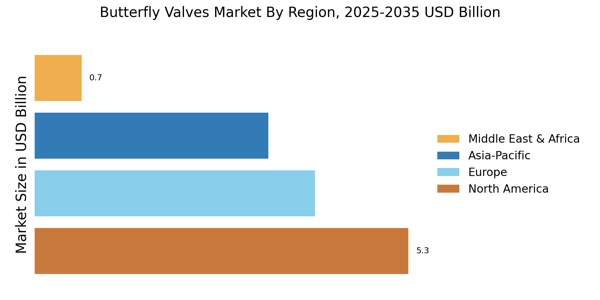

The Butterfly Valves Market is benefiting from the economic development of emerging markets, where infrastructure projects are on the rise. Countries in Asia-Pacific, Latin America, and Africa are investing heavily in infrastructure to support urbanization and industrial growth. This trend is expected to drive demand for butterfly valves, which are essential for various applications, including water supply, sewage treatment, and industrial processes. The infrastructure sector in these regions is projected to grow at a compound annual growth rate of over 5% through 2025. As these markets develop, the need for efficient flow control solutions will likely increase, positioning the Butterfly Valves Market for substantial growth opportunities.

Industrial Automation and Process Control

The Butterfly Valves Market is poised for growth as industrial automation and process control technologies advance. Industries such as chemicals, pharmaceuticals, and food processing are increasingly adopting automated systems to enhance efficiency and reduce operational costs. Butterfly valves, with their ease of integration into automated systems, are becoming essential components in these applications. The Butterfly Valves Market is projected to reach USD 300 billion by 2025, indicating a substantial opportunity for butterfly valve manufacturers. Their ability to provide precise flow control and quick response times aligns well with the demands of modern automated processes. Therefore, the ongoing trend towards automation is likely to drive the Butterfly Valves Market in the coming years.

Regulatory Compliance and Safety Standards

The Butterfly Valves Market is also being shaped by stringent regulatory compliance and safety standards across various sectors. Industries are increasingly required to adhere to environmental regulations and safety protocols, which necessitate the use of reliable and efficient flow control devices. Butterfly valves are recognized for their ability to meet these standards, offering durability and performance in critical applications. As regulations become more stringent, the demand for high-quality butterfly valves is expected to rise. This trend is particularly evident in sectors such as oil and gas, where safety is paramount. The emphasis on compliance is likely to bolster the Butterfly Valves Market, as companies seek to invest in products that ensure operational safety and environmental protection.

Rising Demand in Water and Wastewater Management

The Butterfly Valves Market is experiencing a notable increase in demand driven by the growing need for efficient water and wastewater management systems. As urbanization accelerates, municipalities are investing in infrastructure upgrades to ensure reliable water supply and treatment. This trend is reflected in the projected growth of the water and wastewater sector, which is expected to reach a valuation of approximately USD 1 trillion by 2026. Butterfly valves, known for their lightweight design and cost-effectiveness, are becoming the preferred choice for controlling flow in these systems. Their ability to provide tight sealing and quick operation enhances their appeal in applications where reliability is paramount. Consequently, the rising demand for sustainable water management solutions is likely to propel the Butterfly Valves Market forward.