Rising Awareness of Risk Management

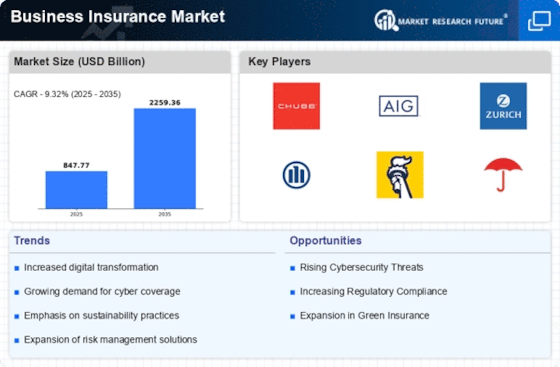

The Business Insurance Market is experiencing a notable increase in awareness regarding risk management among businesses. Companies are increasingly recognizing the importance of safeguarding their assets and operations against unforeseen events. This heightened awareness is driven by the growing complexity of business environments and the potential financial repercussions of risks. As a result, businesses are more inclined to invest in comprehensive insurance solutions to mitigate these risks. According to recent data, the demand for various types of business insurance, including property and liability coverage, has surged, indicating a shift in mindset towards proactive risk management. This trend is likely to continue, as organizations seek to enhance their resilience and ensure long-term sustainability.

Growth of Small and Medium Enterprises (SMEs)

The Business Insurance Market is poised for growth, largely fueled by the expansion of small and medium enterprises (SMEs). As SMEs continue to proliferate, their need for tailored insurance solutions becomes increasingly apparent. These businesses often face unique risks that require specialized coverage, such as business interruption and cyber liability insurance. Recent data suggests that SMEs account for a significant portion of the overall business landscape, contributing to a rising demand for insurance products designed specifically for their needs. This trend is likely to drive innovation within the industry, as insurers develop customized offerings to cater to the diverse requirements of SMEs. The growth of this segment is expected to bolster the overall business insurance market, creating opportunities for insurers to expand their portfolios.

Regulatory Changes and Compliance Requirements

The Business Insurance Market is significantly influenced by evolving regulatory frameworks and compliance requirements. Governments and regulatory bodies are increasingly imposing stringent regulations on businesses, necessitating adequate insurance coverage to protect against liabilities. This trend is particularly evident in sectors such as healthcare, finance, and construction, where compliance with industry-specific regulations is paramount. As businesses strive to meet these requirements, the demand for specialized insurance products is likely to rise. Recent statistics indicate that the market for professional liability insurance has expanded, reflecting the need for businesses to safeguard against potential legal claims. Consequently, regulatory changes are expected to drive growth in the business insurance sector, as companies prioritize compliance and risk mitigation.

Technological Advancements in Insurance Solutions

The Business Insurance Market is undergoing a transformation driven by technological advancements. Innovations such as artificial intelligence, big data analytics, and blockchain are reshaping the way insurance products are developed, marketed, and delivered. These technologies enable insurers to assess risks more accurately, streamline claims processing, and enhance customer experiences. As businesses increasingly adopt digital solutions, the demand for tech-driven insurance products is likely to rise. Recent studies indicate that insurers leveraging technology have reported improved operational efficiency and customer satisfaction. This trend suggests that the integration of technology into the business insurance sector will not only enhance service delivery but also create new opportunities for growth and differentiation in a competitive market.

Increased Focus on Sustainability and Environmental Risks

The Business Insurance Market is witnessing a growing emphasis on sustainability and environmental risks. As businesses become more aware of their environmental impact, there is a corresponding demand for insurance products that address these concerns. Companies are increasingly seeking coverage for environmental liabilities, such as pollution and natural disasters, as part of their risk management strategies. This trend is further fueled by consumer preferences for sustainable practices, prompting businesses to adopt environmentally friendly policies. Recent market analyses indicate that the demand for green insurance products is on the rise, reflecting a shift towards sustainability in the business landscape. This focus on environmental risks is likely to shape the future of the business insurance market, as insurers adapt their offerings to meet the evolving needs of environmentally conscious businesses.