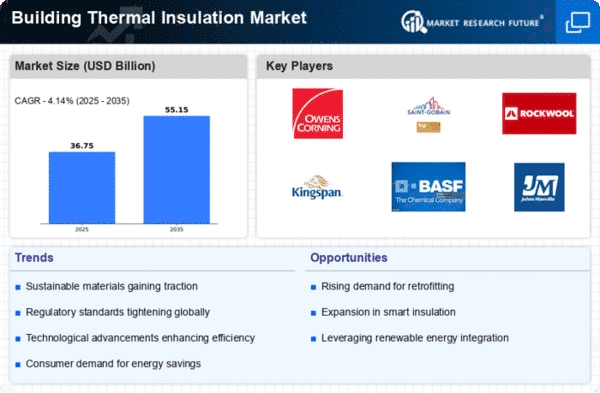

Market Growth Projections

The Global Building Thermal Insulation Market Industry is projected to experience steady growth over the next decade. With a compound annual growth rate (CAGR) of 3.0% anticipated from 2025 to 2035, the market is expected to reach a valuation of 38.2 USD Billion by 2035. This growth trajectory reflects the increasing adoption of thermal insulation solutions across various sectors, including residential, commercial, and industrial applications. The demand for energy-efficient building practices, coupled with technological advancements in insulation materials, is likely to sustain this upward trend, indicating a robust future for the market.

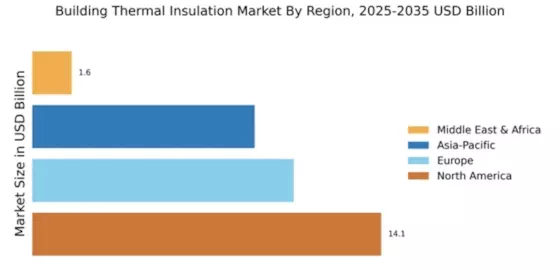

Rising Construction Activities

The resurgence of construction activities globally is significantly influencing the Global Building Thermal Insulation Market Industry. As urbanization accelerates, particularly in developing regions, there is a marked increase in residential and commercial building projects. For example, Asia-Pacific is witnessing rapid urban development, leading to heightened demand for thermal insulation materials. This trend is expected to contribute to the market's growth trajectory, with estimates suggesting a market value of 38.2 USD Billion by 2035. The construction sector's recovery and expansion are likely to create substantial opportunities for insulation manufacturers, thereby bolstering the overall market.

Government Incentives and Subsidies

Government incentives and subsidies aimed at promoting energy-efficient building practices are significantly impacting the Global Building Thermal Insulation Market Industry. Various countries are offering financial support for the adoption of insulation technologies that meet energy efficiency standards. For example, tax credits and rebates for energy-efficient renovations encourage homeowners to invest in thermal insulation solutions. These initiatives not only stimulate market demand but also contribute to the overall reduction of energy consumption in buildings. As governments continue to prioritize energy efficiency, the market is likely to experience sustained growth, driven by these supportive policies.

Growing Demand for Energy Efficiency

The increasing emphasis on energy efficiency in buildings is a primary driver for the Global Building Thermal Insulation Market Industry. Governments worldwide are implementing stringent regulations aimed at reducing energy consumption and greenhouse gas emissions. For instance, the European Union's Energy Performance of Buildings Directive mandates that all new buildings meet high energy performance standards. This regulatory push is expected to propel the market, with projections indicating that the market could reach 27.6 USD Billion by 2024. As energy costs rise, the demand for effective thermal insulation solutions that enhance energy efficiency is likely to grow, further driving market expansion.

Technological Advancements in Insulation Materials

Innovations in insulation technology are reshaping the Global Building Thermal Insulation Market Industry. The development of advanced materials, such as aerogels and vacuum insulation panels, offers superior thermal performance compared to traditional materials. These innovations not only enhance energy efficiency but also contribute to space-saving designs in modern architecture. As architects and builders increasingly seek high-performance solutions, the demand for these advanced insulation materials is likely to rise. The ongoing research and development efforts in this sector may lead to a more competitive market landscape, further driving growth in the coming years.

Increased Awareness of Environmental Sustainability

The growing awareness of environmental sustainability is a crucial driver for the Global Building Thermal Insulation Market Industry. Consumers and businesses alike are becoming more conscious of their environmental impact, leading to a preference for sustainable building practices. This shift is prompting manufacturers to develop eco-friendly insulation materials that minimize carbon footprints. For instance, natural insulation products made from recycled materials are gaining traction. As sustainability becomes a core value in construction, the demand for thermal insulation solutions that align with these principles is expected to rise, potentially enhancing market growth.