Market Share

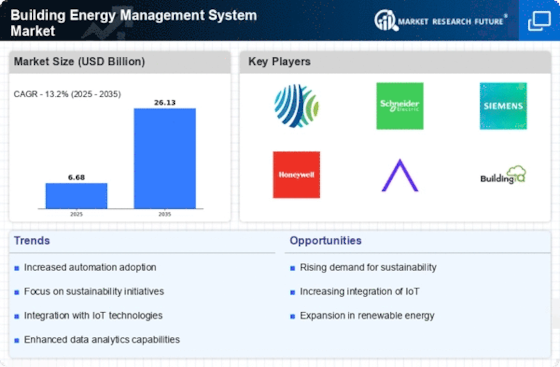

Building Energy Management System Market Share Analysis

The Building Energy Management System (BEMS) sector experiences phenomena when it becomes undeniably a central part in the search for green and energy-efficient building use. BEMS is a complete tool that permits real-time as well as data-based overall building systems management, and helps to reduce energy consumption. On the other hand, a major factor that motivates the growth of the BEMS market is the rapidly growing awareness of the importance of sustainability and care for the environment. Faced with the situation that organizations and building owners try to slash their carbon footprint, BEMS solution is offerring a comprehensive approach. Such approach encompasses energy consumption optimization which results in financial saving at the same time plays an active role in environmental conservation.

The phenomenon of smart building is one of the major market factors that determine the concentration of BMS. The facilities that fall into the category of smart buildings are capable of tapping into some of the most advanced technologies, such as IoT and data analytics, for a better resource utilization and climate control. Placement of such energy systems is the backbone of the smart buildings as they provide real-time details on energy use which lead to intelligent decisions and saving energy. Smart building technologies along with the use of BEMS are now experiencing a revolutionary change in how the buildings are monitored and is leading toward a more collaborative and sustainable built environment.

Two other market trends constituting from the BEMS market's side are energy efficiency regulations and standards. The governments and regulatory bodies all over the world tend to develop stringent energy efficiency standards for the purpose of restricting climate change as well as promoting sustainable lifestyle trends. BEMS solutions are an operator support for owners and operators to be in compliance with these regulations by providing the necessary tools to monitor and control smart energy consumption, track performance, and reporting the adherence to the energy efficiency plans. Such a regulative order is the major contributor to the windmills' spread in the different industries.

The growing realization about the economic gains and returns in energy efficiency is bolstering the structural and functional enhancements of BEMS market. With the rising energy prices, companies identifying the extent of the cost reduction potential are becoming aware about the efficient energy management done properly. BEMS facilitates the discovery of wastage of energy, as well as its highest consumption, and inefficient functions. So, with the elimination of these patterns, there can be a decrease in electricity consumption which leads to the optimization of electricity expenses. This is a penny-wise approach that is an intelligent thing for businesses to invest in order to see increases in their bottomline.

The trend in the monitoringsystem of building energy market has been to move towards cloud based solutions and data analytics. Cloud-based BEMS platforms provide the pinch of scale, flexibility, and accessibility feature therefore the users can optimally monitor and manage the performance of buildings from anywhere they are provided they have a solid internet connection. First add that the operation of data analytics can bring on a deeper understanding of energy usage patterns, predictive maintenance, and optimization possibilities. The consolidation of vast amount of data at the fingertips of owners and facility managers allows them to make informed choices, aimed at making energy efficiency more sustainable and ongoing.

Leave a Comment