Market Growth Projections

The Global Broadcast Equipment Market Industry is poised for substantial growth in the coming years. Projections indicate that the market will reach 5.77 USD Billion in 2024, with an anticipated increase to 11.1 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 6.13% from 2025 to 2035. Such figures highlight the industry's resilience and adaptability in the face of evolving consumer preferences and technological advancements. The increasing demand for high-quality broadcasting solutions, coupled with the expansion of digital platforms, is likely to drive this growth, making the broadcast equipment sector a vital component of the global media landscape.

Technological Advancements

The Global Broadcast Equipment Market Industry experiences a robust growth trajectory driven by rapid technological advancements. Innovations in broadcasting technologies, such as 4K and 8K video formats, enhance the viewing experience, leading to increased demand for high-quality broadcast equipment. Furthermore, the integration of artificial intelligence and machine learning in broadcasting processes streamlines operations and improves content delivery. As a result, the market is projected to reach 5.77 USD Billion in 2024, with a compound annual growth rate of 6.13% anticipated from 2025 to 2035. This growth is indicative of the industry's adaptation to evolving consumer preferences and technological capabilities.

Regulatory Support and Standards

Regulatory support and the establishment of broadcasting standards play a pivotal role in shaping the Global Broadcast Equipment Market Industry. Governments worldwide are increasingly recognizing the importance of broadcasting in promoting cultural content and information dissemination. This recognition often translates into supportive policies and funding initiatives aimed at enhancing broadcasting infrastructure. For instance, initiatives to promote digital broadcasting and ensure compliance with international standards encourage broadcasters to upgrade their equipment. Such regulatory frameworks not only foster market growth but also enhance the overall quality of broadcasting services, ensuring that audiences receive reliable and high-quality content.

Rising Demand for Streaming Services

The surge in streaming services significantly influences the Global Broadcast Equipment Market Industry. As consumers increasingly favor on-demand content, broadcasters are compelled to invest in advanced equipment to deliver high-quality streaming experiences. This shift towards digital platforms necessitates the adoption of sophisticated broadcasting technologies, including cloud-based solutions and content delivery networks. The market's expansion is evident, with projections indicating a rise to 11.1 USD Billion by 2035. This trend underscores the necessity for broadcasters to enhance their infrastructure to meet the growing expectations of viewers, thereby driving equipment sales and innovations.

Emerging Markets and Global Expansion

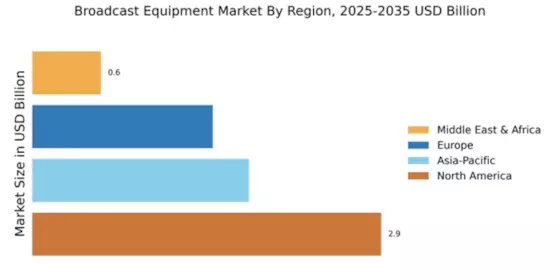

Emerging markets present substantial opportunities for the Global Broadcast Equipment Market Industry. As countries in Asia, Africa, and Latin America experience economic growth, there is a rising demand for broadcasting services and infrastructure. This demand is driven by increasing internet penetration and mobile device usage, which facilitate access to diverse content. Consequently, broadcasters are investing in modern equipment to cater to these expanding audiences. The market's growth potential in these regions is significant, with projections indicating a compound annual growth rate of 6.13% from 2025 to 2035. This expansion reflects the global nature of the broadcasting industry and its adaptability to regional market dynamics.

Increased Investment in Sports Broadcasting

Investment in sports broadcasting serves as a critical driver for the Global Broadcast Equipment Market Industry. Major sporting events, such as the Olympics and World Cup, require extensive broadcasting capabilities, prompting networks to upgrade their equipment. This trend is further fueled by the growing popularity of esports, which demands high-quality broadcasting solutions. The financial commitment to sports broadcasting is substantial, with networks allocating significant budgets for state-of-the-art equipment. This investment is likely to contribute to the market's growth, as broadcasters seek to enhance viewer engagement and deliver immersive experiences, thereby expanding their audience reach.