Growth in Packaging Solutions

The Breathable Films Market is benefiting from the growing demand for innovative packaging solutions. Breathable films are increasingly utilized in food packaging to extend shelf life while maintaining product freshness. The market for breathable packaging is projected to grow as consumers seek convenience and quality in food products. Additionally, the rise of e-commerce and the need for protective packaging solutions are contributing to the demand for breathable films. As manufacturers focus on developing packaging that enhances product preservation and reduces waste, the Breathable Films Market is likely to see continued expansion, driven by these evolving consumer preferences.

Increased Focus on Sustainability

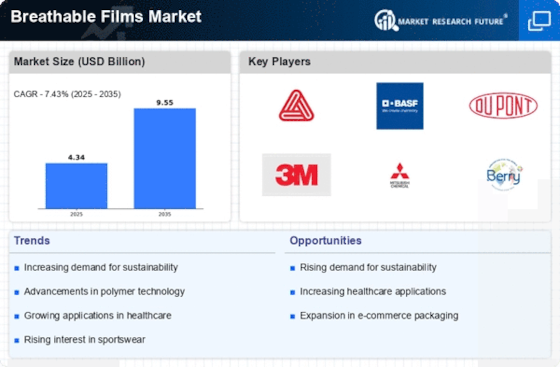

The Breathable Films Market is witnessing a shift towards sustainable materials, driven by growing environmental concerns. Manufacturers are increasingly adopting eco-friendly practices and materials to meet consumer demand for sustainable products. This trend is reflected in the development of biodegradable and recyclable breathable films, which are gaining traction in various applications, including packaging and textiles. The market for sustainable breathable films is expected to grow as companies strive to reduce their carbon footprint and comply with stringent environmental regulations. As consumers become more environmentally conscious, the demand for sustainable breathable films is likely to rise, thereby influencing the overall dynamics of the Breathable Films Market.

Rising Demand in Healthcare Applications

The Breathable Films Market is experiencing a notable surge in demand due to the increasing applications in healthcare. Breathable films are utilized in various medical products, including wound dressings and surgical drapes, which require moisture management and breathability. The market for breathable films in healthcare is projected to grow at a compound annual growth rate (CAGR) of approximately 6% over the next few years. This growth is driven by the rising prevalence of chronic wounds and the need for advanced medical solutions. Furthermore, the emphasis on patient comfort and the reduction of infection risks are propelling the adoption of breathable films in medical settings. As healthcare providers seek innovative materials that enhance patient outcomes, the Breathable Films Market is likely to expand significantly.

Technological Innovations in Material Science

Technological advancements in material science are significantly impacting the Breathable Films Market. Innovations such as the development of new polymer blends and coatings are enhancing the performance characteristics of breathable films. These advancements allow for improved moisture vapor transmission rates and durability, making breathable films more appealing for various applications, including personal care and packaging. The integration of smart technologies, such as moisture sensors, is also emerging, potentially revolutionizing the way breathable films are utilized. As manufacturers continue to invest in research and development, the Breathable Films Market is poised for growth, driven by the introduction of high-performance materials that meet evolving consumer needs.

Expanding Applications in the Textile Industry

The Breathable Films Market is experiencing growth due to the expanding applications in the textile sector. Breathable films are increasingly being used in activewear, outdoor apparel, and protective clothing, where moisture management and comfort are paramount. The global market for breathable textiles is projected to reach substantial figures, with a significant portion attributed to the integration of breathable films. This trend is fueled by the rising consumer demand for high-performance fabrics that offer both functionality and comfort. As the textile industry continues to innovate, the adoption of breathable films is likely to increase, further driving the growth of the Breathable Films Market.