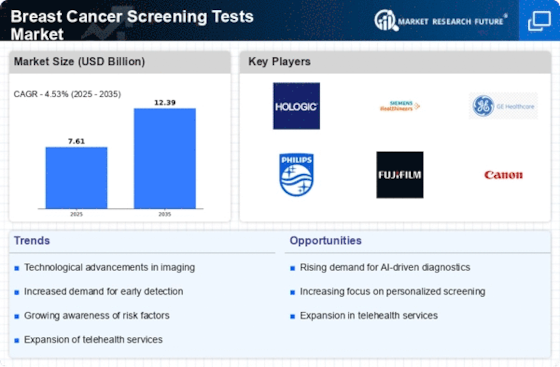

Rising Healthcare Expenditure

Rising healthcare expenditure is a crucial factor propelling the Breast Cancer Screening Tests Market. As countries allocate more resources to healthcare, there is a corresponding increase in funding for cancer screening programs. This trend is particularly evident in regions where healthcare budgets are expanding, allowing for the implementation of comprehensive screening initiatives. Increased investment in healthcare infrastructure also facilitates the adoption of advanced screening technologies, making them more accessible to the population. As healthcare expenditure continues to rise, it is anticipated that the Breast Cancer Screening Tests Market will experience substantial growth, driven by enhanced access to screening services.

Rising Incidence of Breast Cancer

The increasing incidence of breast cancer is a primary driver for the Breast Cancer Screening Tests Market. According to recent statistics, breast cancer remains one of the most prevalent cancers among women, with an estimated 2.3 million new cases diagnosed annually. This alarming trend necessitates enhanced screening measures, as early detection significantly improves treatment outcomes. Consequently, healthcare systems are prioritizing the implementation of advanced screening technologies to address this growing public health concern. The rising incidence not only amplifies the demand for screening tests but also encourages research and development in innovative diagnostic tools, thereby propelling the Breast Cancer Screening Tests Market forward.

Government Initiatives and Funding

Government initiatives aimed at promoting breast cancer awareness and screening programs are pivotal in shaping the Breast Cancer Screening Tests Market. Various countries have established national screening programs, which often include funding for mammography and other diagnostic tests. For instance, initiatives that provide free or subsidized screening services have been shown to increase participation rates among women, particularly in underserved populations. Such programs not only enhance access to screening but also foster a culture of preventive healthcare. The financial backing from government entities is likely to stimulate further advancements in screening technologies, thereby expanding the Breast Cancer Screening Tests Market.

Growing Focus on Preventive Healthcare

The growing emphasis on preventive healthcare is significantly influencing the Breast Cancer Screening Tests Market. As awareness of the benefits of early detection spreads, more individuals are seeking regular screenings as part of their healthcare routine. This shift towards preventive measures is supported by healthcare providers who advocate for routine screenings, particularly for women over the age of 40. The increasing recognition of breast cancer as a critical health issue is likely to drive demand for screening tests, as individuals become more proactive in managing their health. Consequently, this trend is expected to bolster the Breast Cancer Screening Tests Market in the coming years.

Technological Innovations in Screening Methods

Technological innovations are transforming the Breast Cancer Screening Tests Market by introducing more accurate and efficient diagnostic methods. Recent advancements include the development of 3D mammography, also known as tomosynthesis, which has demonstrated improved detection rates compared to traditional 2D mammography. Additionally, the integration of artificial intelligence in image analysis is enhancing the accuracy of screenings, reducing false positives and negatives. These innovations not only improve patient outcomes but also increase the overall efficiency of screening programs. As technology continues to evolve, the Breast Cancer Screening Tests Market is expected to witness significant growth driven by these cutting-edge solutions.