Rising Consumer Demand for Convenience

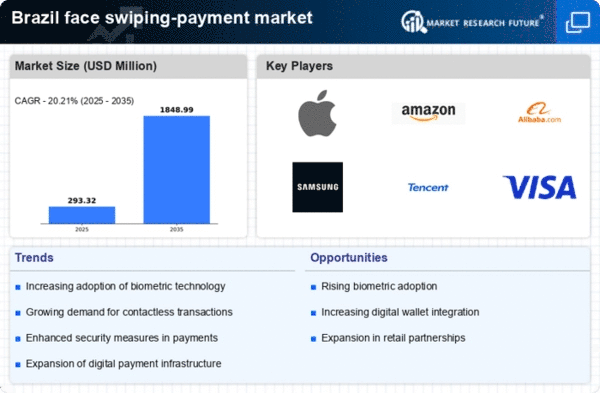

The face swiping-payment market in Brazil is experiencing a notable surge in consumer demand for convenience in transactions. As consumers increasingly seek faster and more efficient payment methods, the adoption of face swiping technology appears to align perfectly with these preferences. Recent surveys indicate that approximately 70% of Brazilian consumers express a desire for contactless payment options, which suggests a strong inclination towards innovative solutions. This trend is further supported by the growing smartphone penetration in Brazil, which reached 80% in 2025. Consequently, the face swiping-payment market is likely to benefit from this shift, as consumers prioritize seamless and quick payment experiences.

Increased Focus on Security and Fraud Prevention

The face swiping-payment market in Brazil is witnessing an increased focus on security and fraud prevention measures. With the rise in digital transactions, concerns regarding data breaches and identity theft have become paramount. In response, Brazilian financial institutions are investing heavily in biometric security solutions, with expenditures projected to reach $500 million by the end of 2025. This investment is likely to enhance the credibility of face swiping technology, as it offers a secure alternative to traditional payment methods. Consequently, the face swiping-payment market is expected to thrive as consumers and businesses alike prioritize secure transaction methods.

Technological Advancements in Facial Recognition

Technological advancements in facial recognition systems are significantly influencing the face swiping-payment market in Brazil. The development of sophisticated algorithms and machine learning techniques has enhanced the accuracy and speed of facial recognition, making it a viable option for secure transactions. In 2025, the Brazilian market has seen a 50% increase in the deployment of advanced facial recognition systems in retail environments. This improvement not only boosts consumer confidence in the security of their transactions but also encourages merchants to adopt face swiping technology. As a result, the face swiping-payment market is poised for growth, driven by these technological innovations.

Government Initiatives to Promote Digital Payments

Government initiatives aimed at promoting digital payments are playing a crucial role in shaping the face swiping-payment market in Brazil. The Brazilian government has implemented various policies to encourage the adoption of digital payment solutions, including tax incentives for businesses that integrate biometric payment systems. As of November 2025, approximately 60% of small and medium-sized enterprises in Brazil have adopted some form of digital payment technology, reflecting the effectiveness of these initiatives. This supportive regulatory environment is likely to foster growth in the face swiping-payment market, as more businesses recognize the benefits of adopting innovative payment solutions.

Growing E-commerce Sector Driving Payment Innovations

The burgeoning e-commerce sector in Brazil is significantly driving innovations in the face swiping-payment market. As online shopping continues to gain traction, with a reported growth rate of 25% in 2025, the demand for secure and efficient payment methods is escalating. E-commerce platforms are increasingly integrating face swiping technology to enhance user experience and streamline transactions. This trend indicates a shift towards more personalized and secure payment options, which could potentially reshape consumer expectations. Therefore, the face swiping-payment market is likely to expand as e-commerce businesses seek to adopt cutting-edge payment solutions to meet the evolving needs of their customers.