Technological Innovations in Stent Design

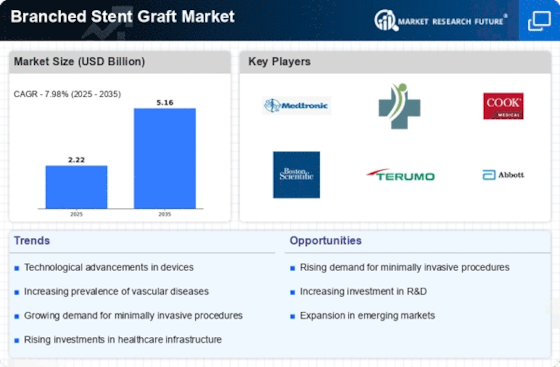

Technological advancements in stent design and materials are significantly influencing the Branched Stent Graft Market. Innovations such as bioresorbable stents and improved delivery systems enhance the efficacy and safety of procedures. These developments not only improve patient outcomes but also reduce recovery times, making them more appealing to both patients and healthcare providers. The market is witnessing a shift towards more sophisticated stent designs that cater to specific anatomical challenges, thereby expanding the application range of branched stent grafts. This trend suggests a robust growth trajectory for the Branched Stent Graft Market as new technologies emerge.

Increasing Prevalence of Vascular Diseases

The rising incidence of vascular diseases, such as aortic aneurysms and peripheral artery disease, is a primary driver for the Branched Stent Graft Market. As populations age, the demand for effective treatment options increases. According to recent data, vascular diseases affect millions worldwide, leading to a surge in procedures requiring branched stent grafts. This trend is likely to continue, as healthcare providers seek innovative solutions to manage complex vascular conditions. The Branched Stent Graft Market is thus positioned to expand, driven by the need for advanced medical interventions that can address these growing health challenges.

Growing Investment in Healthcare Infrastructure

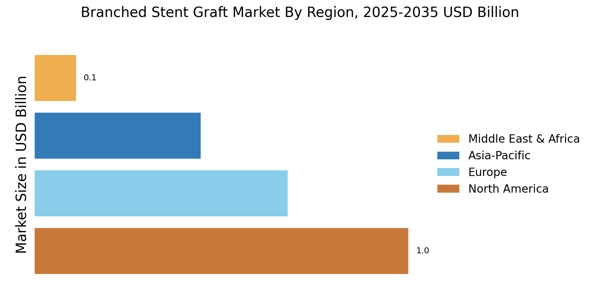

Investment in healthcare infrastructure is a crucial factor driving the Branched Stent Graft Market. As countries enhance their healthcare systems, there is a corresponding increase in the availability of advanced medical technologies, including branched stent grafts. Improved healthcare facilities and access to cutting-edge medical devices enable more patients to receive necessary treatments. This trend is particularly evident in emerging markets, where healthcare investments are rapidly increasing. Consequently, the Branched Stent Graft Market is poised for growth as healthcare systems evolve and expand, providing greater access to innovative treatment options.

Regulatory Support for Advanced Medical Devices

Regulatory bodies are increasingly supportive of innovations in medical devices, including branched stent grafts, which is a key driver for the Branched Stent Graft Market. Streamlined approval processes and guidelines for new technologies encourage manufacturers to invest in research and development. This regulatory environment fosters innovation, allowing for the introduction of safer and more effective stent grafts. As a result, the market is expected to see a rise in new product launches, enhancing competition and expanding the range of options available to healthcare providers. This supportive regulatory landscape is likely to propel the growth of the Branched Stent Graft Market.

Rising Awareness and Acceptance of Minimally Invasive Techniques

There is a growing awareness and acceptance of minimally invasive surgical techniques among both patients and healthcare professionals, which is propelling the Branched Stent Graft Market. Patients increasingly prefer procedures that promise shorter recovery times and reduced hospital stays. This shift in patient preference is supported by clinical evidence demonstrating the benefits of minimally invasive approaches. As a result, healthcare providers are adopting branched stent grafts more frequently, leading to an increase in procedures performed. The Branched Stent Graft Market is thus likely to benefit from this trend, as more patients seek out these advanced treatment options.