Bottled Water Packaging Size

Bottled Water Packaging Market Growth Projections and Opportunities

The bottled water packaging market is driven by the ultimate determinant of growth direction and dynamics, which are market forces. The rising global consumption of bottled water as a portable and convenient form of hydration is one key driver. Consumers are increasingly choosing bottled water over other drinks due to changing lifestyles and increasing health consciousness. Consequently, businesses have been pushed into the packaging market as they try to come up with innovative and eco-friendly ways to satisfy consumer preferences.

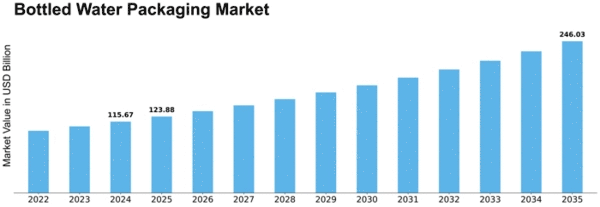

The market size, which stood at USD 100.9 Billion in 2022, will grow at a CAGR of 7.10% from USD 108.0 Billion in 2023 to reach USD187.0 Billion by 2032.

Environmentalism plays another critical role in shaping the bottling water packaging market. As companies and people continue putting more emphasis on sustainability, there is also increasing focus on environment-friendly packing options that can be recycled. Consequently, there has been a change towards materials made from renewable sources or those that can be disposed through biodegradation or recycling mechanisms by suppliers. In response to concerns about plastic pollution and waste, packaging firms have invested significantly into R&D aimed at reducing environmental impact with their products.

It is crucial to note that regulatory policies as well as standards shape the bottled water packaging industry most profoundly. Governments around the world are enacting laws aimed at ensuring packaged waters safety and quality levels are met by vendors among others things Packaging firms need to comply with them apart from it being mandatory so as to earn trust from consumers. Packaging manufacturers have no alternative but continuously monitor regulatory compliance changes so that they adapt their product development approaches accordingly. Whoever said this influences what kind of materials used for packaging bottles manufactured for bottled water?

Finally, competition terrain including market trends has an essential role on how bottled water packages perform amongst all other companies involved within its industry segment. Companies seek differentiation via pack designs such as custom closure design e.g., screw cap, pull-off cap and others. The market is also witnessing novel packaging solutions such as lighter weight and flexible packaging systems that are aimed at enhancing convenience while reducing environmental impact. In addition, branding and marketing strategies play a vital role in influencing consumer attitudes towards bottled water products.

Leave a Comment