Top Industry Leaders in the Bot Services Market

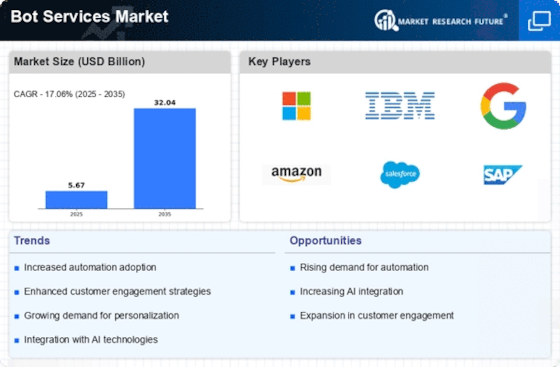

Competitive Landscape of Bot Services Market:

The bot services market, encompassing platforms and tools for building and managing conversational AI agents, is witnessing explosive growth. Driven by advancements in Artificial Intelligence (AI) and Natural Language Processing (NLP), bots are automating tasks across diverse industries, revolutionizing customer service, streamlining internal processes, and enhancing user experiences. This dynamic landscape is rife with competition, with established tech giants and nimble startups vying for market share.

Key Players:

- 24]7.ai (U.S.)

- Amazon Web Services (U.S.)

- Aspect Software (U.S.)

- Astute (U.S.)

- Creative Virtual (U.K.)

- Facebook (U.S.)

- Google LLC (U.S.)

- International Business Machines Corporation (U.S.)

- Inbenta Technologies (U.S.)

- Microsoft Corporation (U.S.)

- Nuance Communications (U.S.)

Factors for Market Share Analysis:

- Platform Features: The breadth and depth of features offered, including NLP capabilities, API integrations, analytics dashboards, and security protocols, play a crucial role in attracting developers and enterprises.

- Ease of Use: Intuitive interfaces, drag-and-drop functionality, and pre-built templates make bot development accessible to non-technical users, widening the target audience.

- Industry Focus: Specialization in specific domains like healthcare, finance, or retail allows platforms to cater to the unique needs and regulations of those industries, boosting adoption.

- Pricing Strategy: Flexible pricing models, with tiers based on usage or features, cater to diverse budgets and business needs, making the platform accessible to a wider range of users.

- Partnerships and Collaborations: Strategic partnerships with technology providers, system integrators, and industry leaders expand reach and credibility, boosting market visibility.

New and Emerging Companies:

- Conversational AI Startups: Companies like Cohere, Rasa, and Rasa Technologies are developing advanced NLP engines and chatbot frameworks, creating the building blocks for future iterations of bot technology.

- Domain-Specific AI Developers: Startups focusing on specific applications, like AI-powered financial assistants or healthcare bots, are emerging to address niche needs within the broader market.

- Open-Source Platforms: Projects like Rasa X and Rasa Open Source offer freely available chatbot development tools, democratizing access and fostering innovation within the bot services ecosystem.

Current Investment Trends:

- Venture Capital: VC firms are actively investing in promising bot services startups, recognizing the market's potential and the competitive edge offered by innovative AI solutions.

- Acquisitions and Mergers: Established players are acquiring niche companies to expand their feature sets and target new customer segments, leading to market consolidation and the emergence of larger players.

- Focus on Integrations: Investments are pouring into developing seamless integrations between bot platforms and existing business software, fostering data exchange and streamlining workflows.

- Security and Privacy: Growing concerns about data privacy and security are driving investments in robust security protocols and ethical AI development practices.

Latest Company Updates:

December 2023, Microsoft acquired Lumenisity, a conversational AI startup, in December 2023 to bolster its chatbot and NLP capabilities.

October 2023, Google AI released LaMDA 3, a new language model, in October 2023, which can be used to develop more advanced and interactive chatbots.

January 2024, Facebook announced new features for its Messenger chatbot platform in January 2024, making it easier for businesses to build and deploy chatbots.