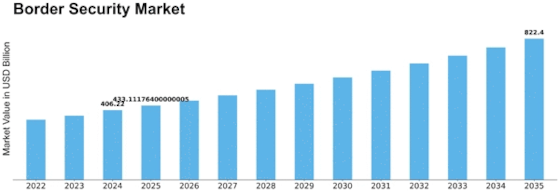

Border Security Size

Border Security Market Growth Projections and Opportunities

The Border Security Market is shaped by dynamic factors that reflect the evolving challenges and complexities in securing national borders across the globe. One fundamental driver is the increasing need for comprehensive border protection measures due to rising security threats, including terrorism, illegal immigration, and transnational crime. As nations face diverse and adaptive security challenges, there is a growing demand for advanced border security solutions to ensure the integrity of borders and safeguard national interests. The market dynamics are driven by the imperative to adopt cutting-edge technologies and strategies that address the evolving nature of security threats along borders.

Technological advancements play a pivotal role in shaping the market dynamics of border security. The adoption of sophisticated surveillance technologies, such as unmanned aerial vehicles (UAVs), ground-based sensors, biometric identification systems, and integrated command and control centers, is on the rise. These technologies enhance situational awareness, enable real-time monitoring, and improve response capabilities, contributing to the overall effectiveness of border security efforts. The market dynamics are influenced by the continuous development and integration of innovative technologies that provide comprehensive and advanced solutions for securing national borders.

International collaborations and partnerships contribute significantly to the market dynamics of border security. As security threats often transcend national boundaries, nations seek collaborative approaches to address shared security concerns. Joint efforts in research, development, and deployment of border security technologies foster global cooperation. Additionally, organizations and alliances, such as the European Union (EU) and North Atlantic Treaty Organization (NATO), play a role in shaping market dynamics by promoting standardized border security measures and facilitating the exchange of information and technologies among member states.

Geopolitical considerations and regional security dynamics influence the market dynamics of border security. Nations facing specific geopolitical challenges or sharing borders with regions prone to instability may prioritize the enhancement of their border security capabilities. The market dynamics are responsive to the geopolitical landscape, with countries adapting their border security strategies and investing in technologies that address regional security concerns. The evolving geopolitical situation, including border disputes and regional conflicts, can impact the demand for border security solutions and shape the overall market dynamics.

Government policies, budget allocations, and regulatory frameworks are crucial factors influencing the market dynamics of border security. Governments worldwide formulate policies and allocate budgets to enhance border security based on perceived threats and national security priorities. Regulatory frameworks set by government agencies guide the procurement, deployment, and operation of border security technologies. The market dynamics are directly affected by the decisions and priorities outlined in national security strategies, shaping the trajectory of investments and innovations in the border security market.

The increasing focus on cybersecurity is an emerging factor influencing the market dynamics of border security. As border security systems become more technologically advanced and interconnected, the risk of cyber threats targeting these systems rises. Governments and organizations involved in border security are placing greater emphasis on securing digital infrastructure to prevent cyberattacks that could compromise the effectiveness of border security measures. The market dynamics are evolving to incorporate cybersecurity considerations, with a growing demand for solutions that ensure the integrity and resilience of border security technologies in the face of cyber threats.

Humanitarian and ethical considerations also play a role in shaping the market dynamics of border security. The deployment of border security measures, such as barriers and surveillance technologies, often raises ethical concerns related to privacy, human rights, and the treatment of individuals crossing borders. The market dynamics are influenced by the need for a balance between effective security measures and the ethical considerations associated with border control. Solutions that address both security imperatives and humanitarian concerns contribute to the evolving landscape of border security.

Leave a Comment