Influence of Fashion and Aesthetics

The Body-Worn Insect Repellent Market is increasingly shaped by the influence of fashion and aesthetics. As consumers seek products that not only provide protection but also align with their personal style, manufacturers are responding by designing aesthetically pleasing insect repellent solutions. This trend is particularly evident among younger demographics who prioritize both functionality and style. The integration of insect repellent technology into wearable items such as clothing and accessories is gaining traction, allowing consumers to seamlessly incorporate protection into their daily lives. Market data indicates that products that combine fashion with functionality are likely to attract a broader audience, thereby expanding the market. As a result, companies may invest in collaborations with fashion designers to create innovative products that appeal to style-conscious consumers.

Growing Demand for Outdoor Activities

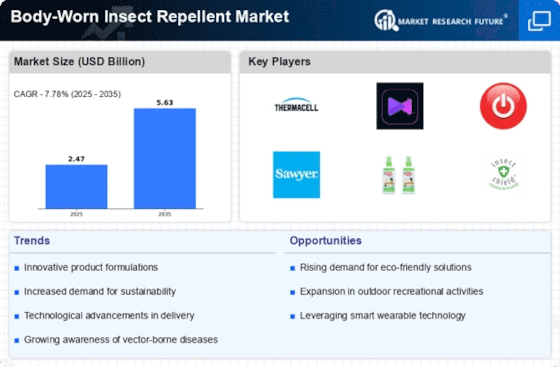

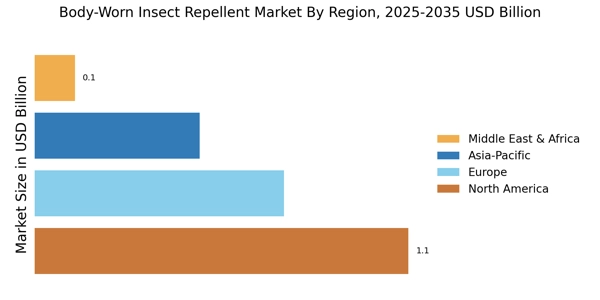

The Body-Worn Insect Repellent Market experiences a notable surge in demand due to the increasing popularity of outdoor activities such as hiking, camping, and fishing. As more individuals engage in these activities, the need for effective insect protection becomes paramount. According to recent data, the outdoor recreation sector has expanded significantly, with millions participating in various outdoor pursuits annually. This trend is likely to drive the sales of body-worn insect repellents, as consumers seek convenient and effective solutions to protect themselves from insect bites. Furthermore, the rise in eco-tourism and adventure travel is expected to further bolster the market, as travelers prioritize safety and comfort during their excursions. Consequently, manufacturers are likely to innovate and diversify their product offerings to cater to this growing consumer base.

Advancements in Formulation Technology

Innovations in formulation technology are transforming the Body-Worn Insect Repellent Market. Manufacturers are increasingly focusing on developing advanced formulations that enhance efficacy while minimizing skin irritation. Recent advancements have led to the creation of long-lasting, water-resistant repellents that provide extended protection against a variety of insects. This is particularly relevant as consumers become more discerning about the products they apply to their skin. Moreover, the introduction of natural and organic ingredients in formulations is gaining traction, appealing to health-conscious consumers. Market data indicates that products featuring natural ingredients are witnessing a rise in demand, reflecting a shift in consumer preferences towards safer alternatives. As a result, companies are likely to invest in research and development to create innovative products that meet these evolving consumer expectations.

Rising Awareness of Vector-Borne Diseases

The Body-Worn Insect Repellent Market is significantly influenced by the rising awareness of vector-borne diseases. As public health campaigns highlight the risks associated with diseases such as malaria, dengue fever, and Zika virus, consumers are becoming increasingly proactive in seeking preventive measures. This heightened awareness is driving the demand for effective insect repellents, particularly in regions where these diseases are prevalent. Data suggests that the incidence of vector-borne diseases has been on the rise, prompting health authorities to recommend the use of insect repellents as a critical preventive strategy. Consequently, this trend is likely to encourage consumers to invest in body-worn insect repellents, thereby expanding the market. Manufacturers may respond by enhancing their marketing strategies to emphasize the protective benefits of their products against these health threats.

Increased Regulatory Support for Safety Standards

The Body-Worn Insect Repellent Market is benefiting from increased regulatory support for safety standards. Governments and health organizations are implementing stricter regulations regarding the safety and efficacy of insect repellent products. This regulatory framework is designed to ensure that consumers have access to safe and effective solutions for insect protection. As a result, manufacturers are compelled to adhere to these standards, which may enhance consumer trust and confidence in their products. Market data suggests that compliance with safety regulations can lead to increased market share for companies that prioritize quality and safety. Furthermore, this regulatory support may encourage innovation, as companies strive to develop products that not only meet but exceed safety requirements. Consequently, the market is likely to witness a shift towards higher-quality offerings that align with consumer expectations for safety and efficacy.