Advancements in Audio Technology

Technological advancements play a crucial role in shaping the bluetooth headphones Market. Innovations such as noise cancellation, high-resolution audio, and enhanced battery life are becoming increasingly prevalent, attracting consumers who prioritize sound quality and performance. The introduction of features like adaptive sound control and voice assistant integration further enhances user experience, making Bluetooth headphones more appealing. Market data suggests that the segment of headphones equipped with advanced audio technology is expected to witness a compound annual growth rate of approximately 15% through 2025. As manufacturers continue to invest in research and development, the Bluetooth Headphones Market is likely to see a proliferation of high-quality products that cater to discerning audiophiles and casual listeners alike.

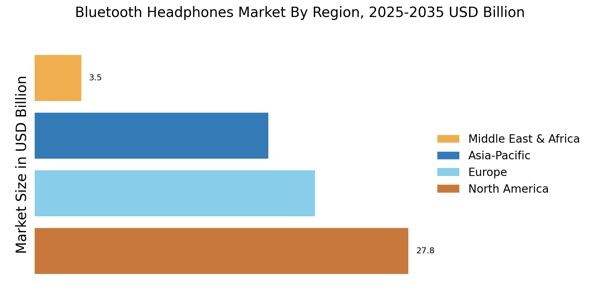

Increased Smartphone Penetration

The proliferation of smartphones has a direct impact on the Bluetooth Headphones Market. With an increasing number of consumers relying on their smartphones for music, calls, and entertainment, the demand for compatible audio accessories has surged. Recent statistics indicate that smartphone penetration is projected to reach over 80% in many regions by 2025, creating a substantial market for Bluetooth headphones. This trend is further amplified by the removal of headphone jacks in many smartphone models, compelling users to seek wireless alternatives. Consequently, the Bluetooth Headphones Market is poised for growth as more consumers invest in wireless headphones to enhance their mobile experience, thereby driving sales and innovation in the sector.

Expansion of E-commerce Platforms

The expansion of e-commerce platforms has a profound impact on the Bluetooth Headphones Market. As online shopping becomes increasingly popular, consumers are more inclined to purchase audio products through digital channels. Recent reports indicate that e-commerce sales in the electronics sector are expected to grow by 20% annually, providing a significant boost to the Bluetooth headphones market. This shift towards online retail allows consumers to access a wider range of products and brands, often at competitive prices. Consequently, the Bluetooth Headphones Market is likely to benefit from this trend, as manufacturers and retailers enhance their online presence and marketing strategies to capture the attention of tech-savvy consumers seeking convenience and variety.

Growing Fitness and Lifestyle Trends

The Bluetooth Headphones Market is significantly influenced by the rising fitness and lifestyle trends among consumers. As health consciousness increases, more individuals are incorporating fitness activities into their daily routines, leading to a higher demand for wireless headphones that offer convenience during workouts. Data suggests that the fitness audio segment is expected to grow at a rate of 12% annually through 2025. Bluetooth headphones, with their lightweight design and sweat-resistant features, are particularly appealing to fitness enthusiasts. This trend not only boosts sales but also encourages manufacturers to develop specialized products tailored for active lifestyles, thereby expanding the Bluetooth Headphones Market and catering to a diverse consumer base.

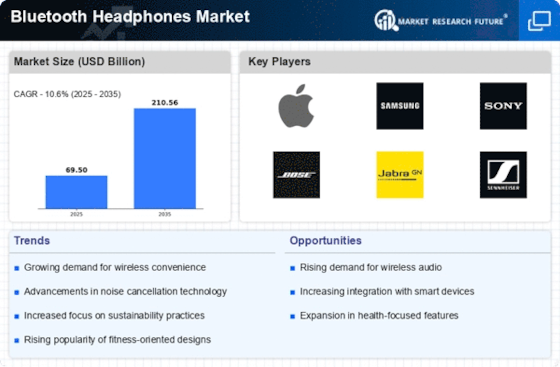

Rising Demand for Wireless Audio Solutions

The Bluetooth Headphones Market experiences a notable surge in demand for wireless audio solutions, driven by the increasing preference for convenience and mobility among consumers. As more individuals seek to eliminate the hassle of tangled wires, the market for Bluetooth headphones is projected to grow significantly. Recent data indicates that the wireless audio segment is expected to account for over 70% of the overall headphones market by 2025. This shift towards wireless technology is not merely a trend; it reflects a fundamental change in consumer behavior, where portability and ease of use are paramount. The Bluetooth Headphones Market is thus positioned to benefit from this growing inclination towards wireless devices, as manufacturers innovate to meet the evolving needs of tech-savvy consumers.