Market Share

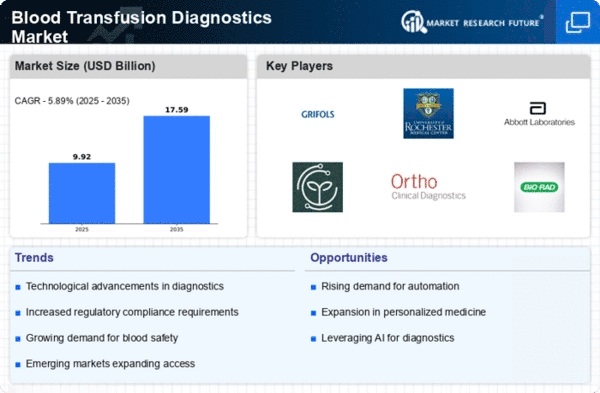

Blood Transfusion Diagnostics Market Share Analysis

The blood transfusion diagnostics industry helps ensure safe and successful transfusions. This ensures patients benefit from blood transfusions. Companies in this field utilize several market share positioning strategies to become industry leaders. This measure is a response to rising worldwide blood product demand. Companies are now offering a wide variety of blood transfusion diagnostic products. This category includes blood grouping and typing reagents, infectious disease screening assays, and cutting-edge compatibility testing technologies. Diverse product lines allow firms to meet healthcare and blood bank needs. This lets enterprises meet these groups' demands. New technologies are needed to compete in blood transfusion diagnosis. For faster and more accurate diagnosis, companies are investing in nucleic acid testing (NAT) and automation. Using many technologies may provide one an edge over competitors. Building good relationships with healthcare institutions and blood banks is crucial to the plan. Close collaboration with these firms may lead to preferred supplier status and long-term contracts, which are financially beneficial. Strategic partnerships like this one also help the organization understand its evolving requirements and connect with key stakeholders for mutual benefit. Due to the worldwide nature of blood transfusion diagnostics, companies are rapidly expanding into foreign markets. This approach requires building distribution networks, forming alliances, and obtaining regulatory clearances in many sectors. Companies benefit from global presence since it helps them access more customers and establishes them as trusted providers. Blood protection is crucial, and companies are striving to lead the way in blood filtering technology. Screening test sensitivity and specificity are being improved to reduce blood transfusion-transmitted illnesses. This research and development aims to improve screening assays. A company's image as a reliable supplier improves when it prioritizes safety. Because blood transfusion tests are so important, regulatory compliance is crucial. Company obligation is to comply with strict regulatory requirements set by health authorities worldwide. This ensures that their goods are high-quality and safe and helps them acquire the confidence of healthcare professionals and regulatory bodies, making it easier to extend their market share. Companies are supporting blood transfusion training programs for medical personnel. This includes instructional materials, workshop organization, and training sessions. Companies may increase product efficiency by providing end-users with information, which boosts customer happiness and loyalty. Businesses are developing cost-effective and expanding nation-specific solutions. Various economic conditions are being considered. This approach offers economical, high-quality diagnostics to suit healthcare system requirements in low-income settings. We do this to meet system needs. Penetration of these markets is crucial to expanding market share. Excellent customer service is crucial to market positioning. More organizations are investing in efficient customer service staff, technical support, and fast-response technologies. Fast assistance and problem-solving help meet client demands. These factors help businesses build long-term collaborations and establish themselves as credible blood transfusion diagnostics partners.

Leave a Comment