Market Share

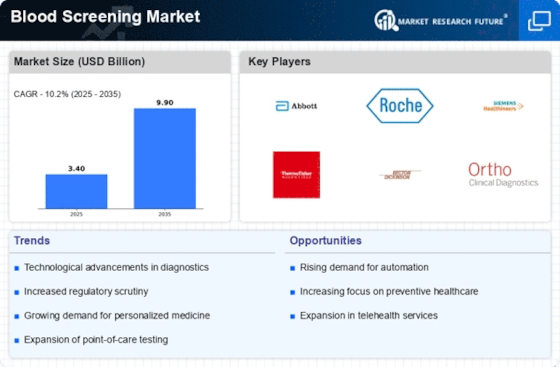

Blood Screening Market Share Analysis

The significance of being a critical component in healthcare has made it so competitive that firms always want higher shares among them. One common strategy used by most firms is differentiating their products from those offered by rivals. This might involve coming up with new technologies through which more accurate diagnostics can be done, like inventing one's biomarkers for use during such tests. Another strategy adopted by key players in this market is cost leadership. By focusing on operational efficiency and economies of scale, businesses can reduce their production costs and offer competitive prices for blood screening services. This has led to the rising popularity of their products among consumers, especially healthcare providers who are always on a budget, thereby increasing their market shares. The blood screening industry is affected by market positioning through strategic partnerships and collaborations. To widen their scope and reach out to new markets, companies may form unions with healthcare facilities, laboratories, or research groups. Another blood screening marketing share-increasing tactic involves expanding geographically. This will enable the corporation to target customers that were hitherto unreachable in such a manner. The expansion may require changing products and services to suit specific regional needs and regulatory requirements. In so doing, organizations make a stronger presence and increase the overall market share. Brand development, together with advertising, also plays an important role in defining a firm's market rate in the blood screening industry. Good brand building creates faithfulness among doctors as well as end users. To have a good image of the brand, firms must demonstrate that they have efficient blood screening services that are accurate when it comes to results obtained. To maintain or extend one's already acquired market share in the blood screening sector, customer-centric strategies are vital. With the aim of better suiting them, companies strive to understand the ever-changing requirements of health providers and labs that purchase their product range. Good customer service provision coupled with training courses related to those services and constant updates of the product based on clients' suggestions results in the satisfaction of these clients, thus ensuring retention.

Leave a Comment