Regulatory Support for Blood Safety

Regulatory bodies worldwide are increasingly emphasizing the importance of blood safety, which significantly impacts the Global Blood Grouping Reagents Market Industry. Stringent regulations regarding blood testing and safety protocols necessitate the use of high-quality reagents for accurate blood typing. Compliance with these regulations ensures that healthcare providers can deliver safe transfusions, thereby enhancing patient outcomes. As regulations evolve, the market is likely to adapt, leading to innovations in reagent development. This regulatory landscape not only supports market growth but also reinforces the commitment to patient safety in transfusion practices.

Rising Demand for Blood Transfusions

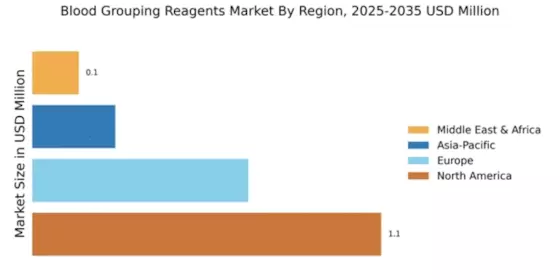

The Global Blood Grouping Reagents Market Industry experiences a notable increase in demand for blood transfusions, driven by a growing prevalence of chronic diseases and surgical procedures. As healthcare systems worldwide expand their capabilities, the need for accurate blood typing becomes paramount. In 2024, the market is projected to reach 0.11 USD Billion, reflecting the urgency for reliable reagents in transfusion medicine. This trend is expected to continue, with the market adapting to the rising number of transfusions required annually, thereby enhancing the overall efficiency of blood banks and hospitals.

Increasing Awareness of Blood Donation

The Global Blood Grouping Reagents Market Industry benefits from heightened awareness regarding the importance of blood donation. Campaigns aimed at educating the public about the need for diverse blood types have led to increased participation in blood donation drives. This surge in donations necessitates the use of effective blood grouping reagents to ensure compatibility and safety. As more individuals engage in donating blood, the demand for reliable reagents is expected to rise, thereby supporting the growth of the market. This trend underscores the critical role of education in fostering a culture of donation.

Market Challenges and Declining Growth Rates

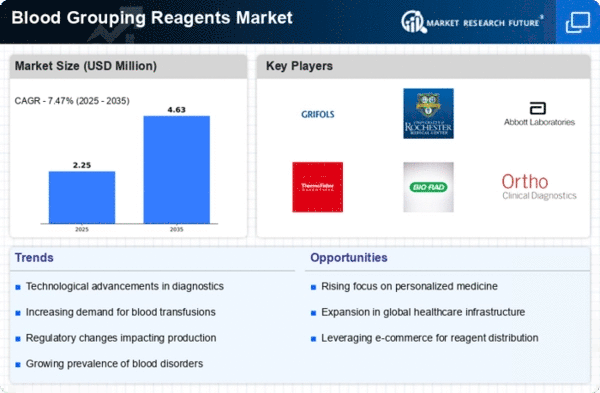

Despite the growth potential, the Global Blood Grouping Reagents Market Industry faces challenges that may hinder its expansion. Projections indicate a compound annual growth rate (CAGR) of -29.29% for the period from 2025 to 2035, suggesting a decline in market activity. Factors contributing to this trend may include saturation in certain regions and the emergence of alternative technologies. As the market navigates these challenges, stakeholders must adapt their strategies to maintain relevance and ensure sustainability in a rapidly changing healthcare landscape.

Technological Advancements in Blood Grouping

Technological innovations play a crucial role in shaping the Global Blood Grouping Reagents Market Industry. The introduction of automated blood grouping systems and advanced reagents enhances accuracy and reduces turnaround times in blood typing processes. These advancements not only improve patient safety but also streamline laboratory workflows. As healthcare facilities increasingly adopt these technologies, the market is likely to witness a surge in demand for high-quality reagents. This trend indicates a shift towards more sophisticated blood grouping solutions, which could potentially lead to a more efficient healthcare delivery system.