Top Industry Leaders in the Blockchain Fintech Market

Competitive Landscape of Blockchain in Fintech Market:

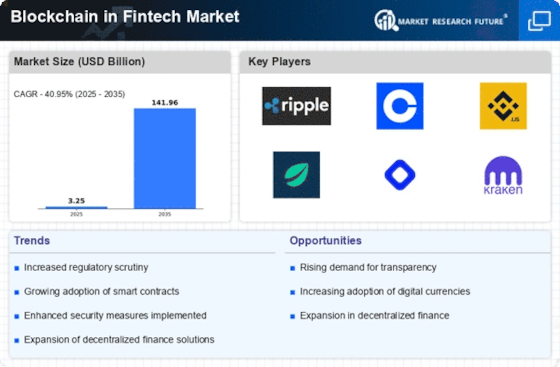

The intersection of blockchain technology and the financial services industry, commonly known as Fintech Blockchain, is experiencing explosive growth. This rapidly evolving landscape boasts a diverse range of players vying for market share, each employing unique strategies to capitalize on the inherent potential of distributed ledger technology. Understanding this competitive landscape is crucial for any company seeking to navigate the intricacies of this burgeoning market.

Key Players:

- AWS (US)

- IBM (US)

- Microsoft (US)

- Ripple (US)

- Chain (US)

- Earthport (UK)

- Bitfury (US)

- BTL Group (Canada)

- Oracle (US)

- Digital Asset Holdings (US)

- Circle (Ireland)

- Factom (US)

- AlphaPoint (US)

- Coinbase (US)

- Ava Labs (New York)

Key Players and Their Strategies:

- Established Tech Giants: Tech behemoths like Amazon Web Services (AWS), Microsoft, and IBM are leveraging their vast resources and cloud computing expertise to offer blockchain-as-a-service (BaaS) solutions. These platforms cater to businesses of all sizes, enabling them to seamlessly integrate blockchain into their operations without the need for extensive technical infrastructure.

- Financial Institutions: Traditional banks and financial institutions are actively exploring blockchain's potential to streamline internal processes, enhance transparency, and reduce costs. JP Morgan Chase, for instance, is developing Liink, a blockchain-based platform for interbank payments, while Wells Fargo is experimenting with blockchain for trade finance and know-your-customer (KYC) verification.

- Fintech Startups: Agile startups are at the forefront of innovation, driving the development of novel blockchain applications across various financial sectors. Ripple Labs, for example, focuses on cross-border payments, while Circle is building a global digital currency payment network.

- Blockchain Consortiums: Collaborative efforts like Hyperledger Fabric and R3 Corda are paving the way for industry-specific blockchain solutions. These consortia bring together leading players from different sectors to develop and implement standardized blockchain platforms tailored to specific use cases.

Factors Influencing Market Share:

- Technological Prowess: Possession of cutting-edge blockchain technology and expertise in developing secure and scalable solutions is paramount.

- Regulatory Landscape: Navigating the evolving regulatory environment surrounding blockchain and cryptocurrencies is crucial for long-term success.

- Partnerships and Collaborations: Building strategic partnerships with established players in the financial ecosystem can accelerate market penetration and adoption.

- Marketing and Branding: Effective communication and building a strong brand reputation are essential for attracting both businesses and individual users.

New and Emerging Players:

The Fintech Blockchain landscape is constantly evolving, with new players emerging to address specific market needs. Some notable examples include:

- Chainlink: Provides secure oracles for connecting blockchain applications to real-world data and events.

- Elliptic Labs: Develops AI-powered transaction fraud detection solutions utilizing blockchain technology.

- BlockFi: Offers crypto-backed loans and interest-earning accounts, bridging the gap between traditional finance and decentralized finance (DeFi).

Current Investment Trends:

- Venture Capital: VC firms are pouring billions into promising Fintech Blockchain startups, with a focus on areas like DeFi, cross-border payments, and blockchain-based asset management.

- Private Equity: Private equity firms are showing increasing interest in established Fintech Blockchain companies with proven business models and robust growth potential.

- Strategic Investments: Traditional financial institutions and tech giants are making strategic investments in promising blockchain startups to gain access to cutting-edge technology and expertise.

Latest Company Updates:

Oct 26, 2023, The Securities and Exchange Commission (SEC) in the US proposed amendments to its custody rule, potentially paving the way for crypto assets to be held by qualified custodians like banks and trust companies.

Nov 10, 2023, The European Central Bank (ECB) announced its plans for a digital euro, aiming to launch a pilot phase in mid-2024. The project will explore the use of blockchain technology for the digital currency.

Dec 14, 2023, The United Arab Emirates (UAE) unveiled its first regulatory framework for cryptocurrencies and related activities, aiming to establish itself as a global hub for the industry.