Biomaterial Wound Dressing Size

Market Size Snapshot

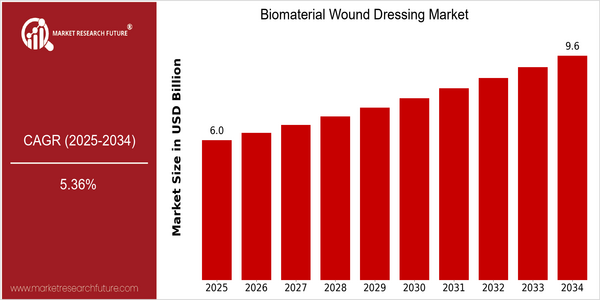

| Year | Value |

|---|---|

| 2025 | USD 5.98 Billion |

| 2034 | USD 9.57 Billion |

| CAGR (2025-2034) | 5.36 % |

Note – Market size depicts the revenue generated over the financial year

The market for wound dressings will grow significantly from 2025, reaching $ 5.98 billion in 2025, and reaching $ 9.57 billion by 2034, with a CAGR of 5.36%. This upward trend reflects the high demand for wound dressings in the face of the growing number of chronic wounds, surgical procedures and the aging population. The market is also favored by technological developments in biomaterials, such as the development of smart dressings, which can monitor the wound and deliver drugs. , improving patient outcomes and reducing health costs. The major players in the biomaterial wound dressing market, such as Smith & Nephew, 3M and Medtronic, are engaging in strategic initiatives such as alliances, acquisitions and product innovations to strengthen their market positions. Product launches with antimicrobial and moisture management properties reflect the industry's focus on improving the healing process. Competition is also expected to intensify between companies in the wound dressing market, as well as between medical devices and medical devices. Besides, collaborations between health care professionals and technology companies will help to integrate digital health solutions into wound care, which will further promote market growth. The above factors will be crucial to the future development of the wound dressing industry.

Regional Market Size

Regional Deep Dive

The Biomaterials Dressings Market is expected to grow at a CAGR of over 6%, during the forecast period, driven by the increasing prevalence of chronic wounds, advancements in biomaterials technology, and a rising focus on effective wound care management. Each region has a unique market structure, influenced by the regulatory framework, the availability of healthcare resources, and the cultural and religious attitudes towards medicine. The growing demand for advanced wound care solutions has led to the introduction of new biomaterials dressings, which enhance the healing process and improve patient outcomes.

Europe

- Europe is distinguished by a great concern for research and development, and organisations such as the European Society for the Study of Wounds and their Treatment are constantly striving to improve the practice of wound care. There is also a growing interest in the use of bioengineered skin substitutes, which are beginning to be used in clinical practice.

- The European Union's stringent regulations on medical devices are pushing manufacturers to invest in high-quality biomaterials, ensuring that products meet safety and efficacy standards, which is expected to enhance consumer trust and market growth.

Asia Pacific

- Besides, the biomaterials wound dressings market is booming in Asia-Pacific, driven by the growing spending on health and the growing awareness of advanced wound care solutions. Japan and Australia, for example, are at the forefront of the use of these biomaterials, which are also supported by government initiatives to improve the health care system.

- Local companies are also entering the market with cost-effective solutions tailored to meet the specific needs of the region, which is expected to increase accessibility and drive market penetration.

Latin America

- In the last few years, Latin America has gradually been moving towards the use of advanced wound-care solutions, prompted by an increase in investment in health and a rise in the number of chronic wounds. Coloplast is increasing its presence in the region and introducing new biomaterial dressings that are adapted to local needs.

- Government programs aimed at improving healthcare access and quality are also playing a crucial role in promoting the adoption of biomaterial wound dressings, which is expected to enhance patient outcomes and market growth.

North America

- The North American market is witnessing an increasing adoption of advanced biomaterial wound dressings, particularly as a result of the increasing prevalence of diabetes and chronic wounds associated with diabetes. The major companies in this field, such as 3M and Smith & Nephew, are developing new products with antimicrobial properties to prevent infections.

- Regulatory changes, such as the FDA's expedited review process for novel wound care products, are facilitating faster market entry for new biomaterials, thereby enhancing competition and innovation in the region.

Middle East And Africa

- In the Middle East and Africa, the market is influenced by the increasing population and the rising number of people suffering from chronic diseases. This has led to an increased demand for wound care products. In addition, the World Health Organization is promoting wound care practices in the region.

- The region's unique cultural practices and varying healthcare regulations are shaping the market, with a focus on traditional healing methods alongside modern biomaterial solutions, which is expected to create a diverse product landscape.

Did You Know?

“Did you know that the global market for biomaterial wound dressings is expected to see a significant increase in demand due to the rising incidence of diabetic foot ulcers, which affect approximately 15% of diabetic patients?” — International Diabetes Federation

Segmental Market Size

The biomaterials wound dressings segment is playing an important role in the overall wound care market, which is currently growing steadily due to the growing awareness of advanced wound care solutions. The increasing occurrence of chronic wounds, such as diabetic foot ulcers and pressure ulcers, as well as the increasing preference for biocompatible materials that support rapid healing, are the main drivers of this market. Also, favourable regulations and the increasing focus of medical institutions on achieving better patient outcomes are boosting demand for innovative wound care products. The biomaterials wound dressings market is currently in the mature phase of its development, with the likes of Smith & Nephew and 3M leading the way with their innovation. These wound dressings are mainly used in surgical wounds, burns and chronic wounds, where they are applied in the form of hydrogels and alginates. Nevertheless, the market is still growing, mainly due to the increasing focus on sustainable development and the pandemic of influenza A (H1N1), which has increased the need for effective wound care. Nanotechnology and smart dressings are shaping the development of this market, as they are facilitating faster healing and improved patient monitoring.

Future Outlook

The Biomaterial Wound Dressings Market is expected to grow at a CAGR of 5.36% from 2025 to 2034. The growth is driven by the rising geriatric population and the prevalence of chronic wounds, such as diabetic ulcers and pressure ulcers, which requires advanced wound care solutions. The focus on patient-centric care is also driving the demand for advanced wound care solutions, which are expected to witness a higher market penetration among the end users. Also, the development of smart wound dressings, which are embedded with sensors, is expected to drive the market growth. Furthermore, government initiatives to improve the healthcare infrastructure and fund wound care research are expected to further drive the market growth. The integration of nanotechnology in wound dressings is also expected to provide sustainable and effective wound care solutions. This is expected to position the wound dressings market as a crucial segment of the healthcare industry.

Leave a Comment