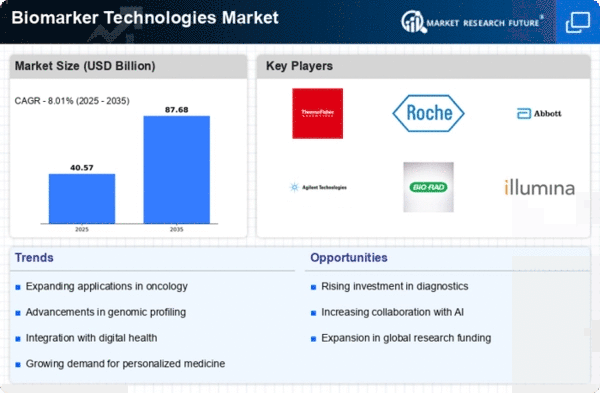

Market Growth Projections

The Global Biomarker Technologies Market Industry is projected to experience substantial growth over the coming years. With a market value of 37.6 USD Billion in 2024, it is anticipated to expand at a CAGR of 8.01% from 2025 to 2035, potentially reaching 87.7 USD Billion by 2035. This growth trajectory reflects the increasing demand for biomarker technologies across various applications, including diagnostics, drug development, and personalized medicine. The convergence of technological advancements, rising chronic disease prevalence, and regulatory support further underscores the market's potential for expansion.

Increased Investment in R&D

The Global Biomarker Technologies Market Industry benefits from heightened investment in research and development across various sectors, including pharmaceuticals and biotechnology. Governments and private entities are allocating substantial funds to explore biomarker applications in drug discovery and development. For instance, the National Institutes of Health has prioritized biomarker research, recognizing its potential to enhance therapeutic efficacy and safety. This influx of funding fosters innovation and accelerates the development of novel biomarker technologies. Consequently, the market is poised for significant growth, with projections indicating a rise to 37.6 USD Billion in 2024.

Advancements in Genomic Technologies

Technological advancements in genomics significantly influence the Global Biomarker Technologies Market Industry. Innovations such as next-generation sequencing and CRISPR gene editing enhance the ability to identify and validate biomarkers. These technologies facilitate the discovery of novel biomarkers that can lead to breakthroughs in diagnostics and therapeutics. For example, the integration of genomic data into clinical practice has improved patient stratification in oncology. As the market evolves, it is projected to grow at a CAGR of 8.01% from 2025 to 2035, potentially reaching 87.7 USD Billion by 2035, underscoring the importance of genomic advancements.

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases globally drives the Global Biomarker Technologies Market Industry. Conditions such as cancer, diabetes, and cardiovascular diseases necessitate advanced diagnostic tools for early detection and personalized treatment. For instance, the World Health Organization indicates that cancer cases are projected to rise by 70% over the next two decades. This surge in chronic diseases creates a substantial demand for biomarker technologies, which are essential for developing targeted therapies. The market is expected to reach 37.6 USD Billion in 2024, reflecting the urgent need for innovative solutions in disease management.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is a pivotal driver for the Global Biomarker Technologies Market Industry. As healthcare moves away from one-size-fits-all approaches, biomarkers play a crucial role in tailoring treatments to individual patient profiles. This trend is evident in oncology, where biomarkers guide treatment decisions based on genetic and molecular characteristics. The increasing acceptance of personalized medicine is likely to propel market growth, as healthcare providers seek to improve patient outcomes. The market is expected to expand significantly, potentially reaching 87.7 USD Billion by 2035, reflecting the growing emphasis on personalized therapeutic strategies.

Regulatory Support for Biomarker Development

Regulatory agencies worldwide are increasingly supporting the development and validation of biomarkers, which positively impacts the Global Biomarker Technologies Market Industry. Initiatives aimed at streamlining the approval process for biomarker-based diagnostics and therapeutics encourage innovation and investment. For example, the U.S. Food and Drug Administration has established guidelines to facilitate the use of biomarkers in drug development. This regulatory support not only accelerates the introduction of new biomarker technologies but also enhances their credibility in clinical settings. As a result, the market is anticipated to grow, reaching 37.6 USD Billion in 2024.