Rising Environmental Regulations

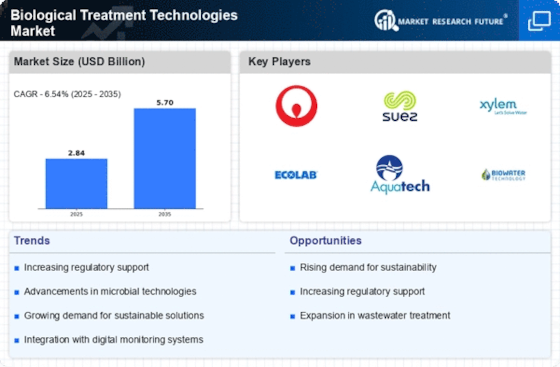

The Biological Treatment Technologies Market is experiencing a surge in demand due to increasing environmental regulations aimed at reducing pollution and promoting sustainable practices. Governments worldwide are implementing stringent laws to control waste management and emissions, which necessitates the adoption of biological treatment technologies. For instance, regulations concerning wastewater treatment and landfill management are becoming more rigorous, compelling industries to invest in advanced biological solutions. This trend is expected to drive the market as companies seek compliance while minimizing their environmental footprint. The market is projected to grow at a compound annual growth rate of approximately 8% over the next five years, reflecting the urgency for effective biological treatment solutions.

Increasing Population and Urbanization

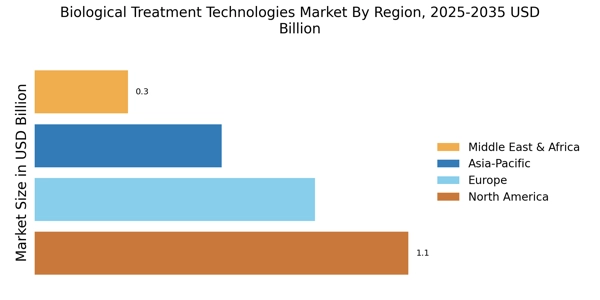

The Biological Treatment Technologies Market is significantly influenced by the increasing population and rapid urbanization trends. As urban areas expand, the demand for effective waste management solutions intensifies, necessitating the implementation of biological treatment technologies. Urban centers are facing challenges related to waste generation and pollution, prompting local governments and industries to seek efficient biological treatment options. This demographic shift is expected to drive the market, as more municipalities and businesses invest in biological treatment systems to address the growing waste management needs. Projections indicate that the market could grow by approximately 6% annually, reflecting the urgent need for sustainable waste treatment solutions in urban environments.

Investment in Research and Development

Investment in research and development is a crucial driver for the Biological Treatment Technologies Market. As the need for innovative and effective biological treatment solutions grows, companies are allocating significant resources to R&D initiatives. This focus on innovation is leading to the development of new biological treatment methods and technologies that can address complex waste challenges. Enhanced research efforts are also fostering collaborations between academic institutions and industry players, further propelling advancements in biological treatment technologies. The market is likely to benefit from this trend, with an expected growth rate of around 8% over the next several years, as new technologies emerge to meet evolving environmental standards and consumer demands.

Growing Awareness of Sustainable Practices

There is a notable increase in awareness regarding sustainable practices among industries and consumers, which is significantly influencing the Biological Treatment Technologies Market. As stakeholders become more conscious of their environmental impact, the demand for eco-friendly treatment solutions is rising. This shift is prompting companies to adopt biological treatment technologies that not only comply with regulations but also enhance their corporate social responsibility profiles. The market is likely to see a substantial increase in investments in biological treatment systems, as organizations aim to align their operations with sustainability goals. This trend is expected to contribute to a market growth rate of around 7% annually, as more entities recognize the long-term benefits of sustainable practices.

Technological Advancements in Treatment Processes

Technological advancements are playing a pivotal role in shaping the Biological Treatment Technologies Market. Innovations such as enhanced microbial processes, bioreactors, and integrated treatment systems are improving the efficiency and effectiveness of biological treatments. These advancements enable the treatment of a wider range of contaminants, thereby expanding the applicability of biological technologies across various sectors, including wastewater management and industrial processes. The introduction of smart technologies, such as IoT-enabled monitoring systems, is further optimizing treatment processes, leading to cost reductions and improved outcomes. As a result, the market is anticipated to witness a growth trajectory of approximately 9% over the next few years, driven by the continuous evolution of treatment technologies.