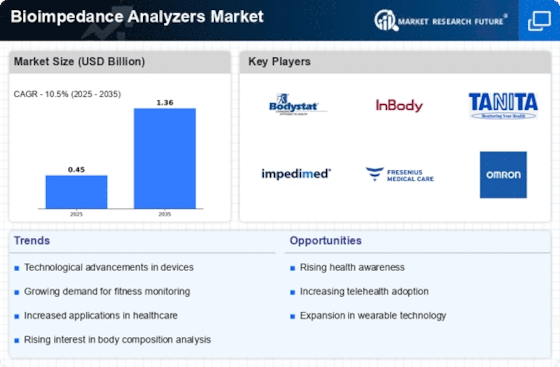

Bioimpedance Analyzers Market Summary

As per Market Research Future analysis, the Bioimpedance Analyzers Market Size was estimated at 0.453 USD Billion in 2024. The Bioimpedance Analyzers industry is projected to grow from USD 0.5006 Billion in 2025 to USD 1.359 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 10.5% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Bioimpedance Analyzers Market is experiencing robust growth driven by technological advancements and a focus on preventive healthcare.

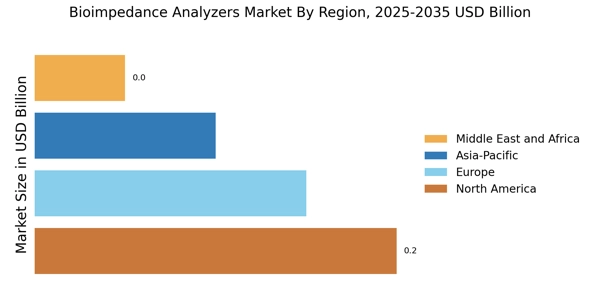

- North America remains the largest market for bioimpedance analyzers, driven by advanced healthcare infrastructure and high demand for non-invasive diagnostic tools.

- The Asia-Pacific region is the fastest-growing market, reflecting increasing investments in healthcare and rising awareness of chronic disease management.

- Multi-frequency bioimpedance analyzers dominate the market, while single-frequency devices are emerging as the fastest-growing segment due to their cost-effectiveness.

- Key market drivers include the rising demand for non-invasive diagnostic tools and the integration of bioimpedance technology with fitness and wellness applications.

Market Size & Forecast

| 2024 Market Size | 0.453 (USD Billion) |

| 2035 Market Size | 1.359 (USD Billion) |

| CAGR (2025 - 2035) | 10.5% |

Major Players

Bodystat Ltd (GB), InBody Co Ltd (KR), Tanita Corporation (JP), ImpediMed Limited (AU), Fresenius Medical Care AG & Co KGaA (DE), Omron Healthcare, Inc. (JP), Seca GmbH & Co. KG (DE), Nutritional Science Corporation (US)