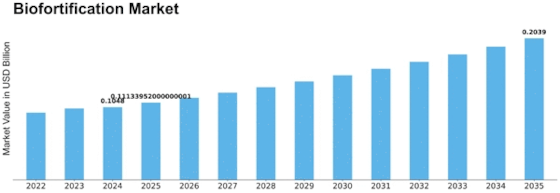

Biofortification Size

Biofortification Market Growth Projections and Opportunities

Biofortification market size is shaped by several key factors that influence its growth and trajectory. One significant factor is the increasing global concern about malnutrition and micronutrient deficiencies. Despite advancements in food production, millions of people worldwide suffer from deficiencies in essential vitamins and minerals, such as vitamin A, iron, zinc, and iodine, which are critical for human health and development. Biofortification, which involves breeding crops to enhance their nutritional content, offers a sustainable and cost-effective solution to address these deficiencies by increasing the availability of essential nutrients in staple food crops consumed by vulnerable populations.

Government policies and initiatives also play a crucial role in driving the biofortification market. Many governments and international organizations have recognized the importance of addressing malnutrition and have implemented programs and policies to promote biofortified crops as part of broader nutrition strategies. These initiatives include research funding, agricultural subsidies, public-private partnerships, and regulatory support to incentivize the development, adoption, and dissemination of biofortified crop varieties. Additionally, government procurement programs and food assistance initiatives contribute to increasing the availability and accessibility of biofortified foods for populations at risk of malnutrition.

Furthermore, consumer awareness and demand for nutritious and functional foods drive the growth of the biofortification market. As consumers become more health-conscious and seek natural solutions to improve their diets, there is a growing demand for foods that offer enhanced nutritional benefits. Biofortified foods, which offer higher levels of essential vitamins and minerals compared to conventional varieties, appeal to health-conscious consumers looking to address nutrient deficiencies and improve overall well-being. Additionally, consumer education campaigns and marketing efforts raise awareness about the nutritional benefits of biofortified foods, driving consumer acceptance and adoption.

Technological advancements in plant breeding and biotechnology play a crucial role in accelerating the development and commercialization of biofortified crop varieties. Innovative breeding techniques, such as marker-assisted selection, genetic engineering, and gene editing, enable breeders to efficiently introduce and stack beneficial traits for enhanced nutrient content, yield, and agronomic performance. Additionally, advancements in agronomic practices, such as soil management, fertilization, and irrigation, help optimize nutrient uptake and bioavailability in biofortified crops, maximizing their nutritional impact on consumers.

Moreover, partnerships and collaborations between public and private stakeholders drive innovation and investment in the biofortification market. Research institutions, agricultural organizations, seed companies, NGOs, and international development agencies collaborate to develop and disseminate biofortified crop varieties tailored to the needs of specific regions and target populations. Public-private partnerships facilitate technology transfer, capacity building, and market development initiatives, accelerating the adoption and impact of biofortified crops in addressing malnutrition and improving public health outcomes.

Environmental sustainability and climate resilience are also important factors influencing the biofortification market. Climate change, soil degradation, and water scarcity pose challenges to agricultural production and food security, particularly in vulnerable regions with limited resources and infrastructure. Biofortified crops with enhanced resilience to environmental stresses and improved nutritional content offer sustainable solutions to mitigate the adverse effects of climate change on food production and nutrition. Additionally, agroecological approaches, such as intercropping, crop rotation, and conservation agriculture, complement biofortification efforts by enhancing soil fertility, biodiversity, and ecosystem services.

In conclusion, the biofortification market size is influenced by various market factors, including global malnutrition, government policies, consumer demand, technological advancements, partnerships, environmental sustainability, and climate resilience. These factors collectively drive the development, adoption, and commercialization of biofortified crop varieties as an effective and sustainable solution to address nutrient deficiencies and improve public health outcomes worldwide. However, ensuring equitable access, affordability, and acceptance of biofortified foods remains essential to maximize their impact on malnutrition and promote sustainable food systems for future generations.

Leave a Comment