Increasing Environmental Regulations

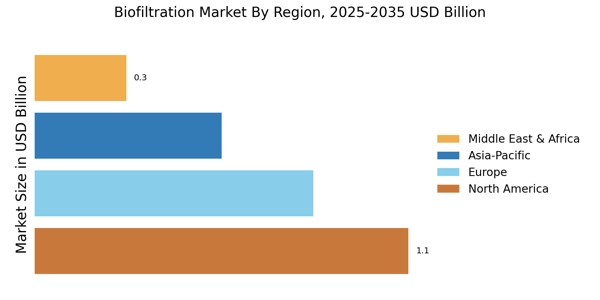

The Biofiltration Market is experiencing a surge in demand due to the tightening of environmental regulations across various sectors. Governments are implementing stricter guidelines to control air and water pollution, which necessitates the adoption of biofiltration technologies. For instance, industries such as wastewater treatment and air purification are increasingly required to meet specific emission standards. This regulatory pressure is driving investments in biofiltration systems, as companies seek to comply with environmental laws while minimizing their ecological footprint. The market is projected to grow as more organizations recognize the importance of sustainable practices and the role of biofiltration in achieving compliance. As a result, the Biofiltration Market is likely to see a significant uptick in both innovation and market penetration.

Growing Demand for Clean Water Solutions

The demand for clean water solutions is escalating, significantly impacting the Biofiltration Market. With increasing population and industrial activities, the pressure on water resources is intensifying, leading to a greater need for effective water treatment technologies. Biofiltration Market systems are recognized for their ability to remove contaminants and improve water quality, making them an attractive option for municipalities and industries alike. The market is projected to grow as more entities invest in biofiltration to ensure access to clean water. This trend underscores the critical role of biofiltration in addressing water scarcity and pollution challenges, positioning the Biofiltration Market for continued expansion.

Integration with Waste Management Systems

The integration of biofiltration technologies with existing waste management systems is becoming increasingly prevalent, thereby driving the Biofiltration Market. As municipalities and industries seek comprehensive solutions for waste treatment, biofiltration offers a viable option for enhancing the efficiency of these systems. By incorporating biofiltration into waste management strategies, organizations can achieve better pollutant removal and resource recovery. This trend is particularly evident in urban areas where waste management challenges are more pronounced. The Biofiltration Market is expected to benefit from this integration, as it provides a synergistic approach to waste treatment that aligns with modern sustainability goals.

Rising Awareness of Sustainable Practices

There is a growing awareness among industries and consumers regarding the importance of sustainable practices, which is positively influencing the Biofiltration Market. As environmental concerns become more prevalent, businesses are increasingly adopting eco-friendly technologies to enhance their sustainability profiles. Biofiltration Market systems, which utilize natural processes to treat pollutants, align well with these sustainability goals. The market is witnessing a shift as companies recognize that investing in biofiltration not only helps in waste management but also improves their brand image. This trend is expected to drive the Biofiltration Market forward, as more organizations seek to implement sustainable solutions that resonate with environmentally conscious consumers.

Technological Innovations in Biofiltration

Technological advancements are playing a crucial role in shaping the Biofiltration Market. Innovations in materials, design, and operational efficiency are enhancing the effectiveness of biofiltration systems. For example, the development of advanced biofilters that utilize specific microorganisms to target particular pollutants is gaining traction. These innovations not only improve the performance of biofiltration systems but also reduce operational costs, making them more attractive to industries. The market is likely to expand as these technologies become more accessible and affordable, allowing a wider range of applications. Consequently, the Biofiltration Market is poised for growth as technological breakthroughs continue to emerge.