Growing Awareness of Preventive Healthcare

The Bioelectronic Sensors Market is also witnessing growth due to the increasing awareness of preventive healthcare. As individuals become more health-conscious, there is a rising demand for tools that facilitate proactive health management. Bioelectronic sensors play a crucial role in this paradigm shift by enabling users to monitor their health metrics continuously. This trend is supported by Market Research Future indicating that the preventive healthcare market is expected to reach USD 4 trillion by 2026. The ability of bioelectronic sensors to provide real-time feedback empowers users to make informed health decisions, thereby driving the adoption of these technologies in everyday life and contributing to the overall growth of the Bioelectronic Sensors Market.

Rising Demand for Remote Patient Monitoring

The Bioelectronic Sensors Market is experiencing a notable surge in demand for remote patient monitoring solutions. This trend is largely driven by the increasing prevalence of chronic diseases, which necessitate continuous health monitoring. According to recent estimates, the number of individuals with chronic conditions is projected to reach 1.5 billion by 2025. Bioelectronic sensors facilitate real-time data collection, enabling healthcare providers to monitor patients' health remotely. This capability not only enhances patient outcomes but also reduces healthcare costs associated with hospital visits. As a result, the integration of bioelectronic sensors into telehealth platforms is becoming increasingly prevalent, indicating a robust growth trajectory for the Bioelectronic Sensors Market.

Technological Advancements in Sensor Design

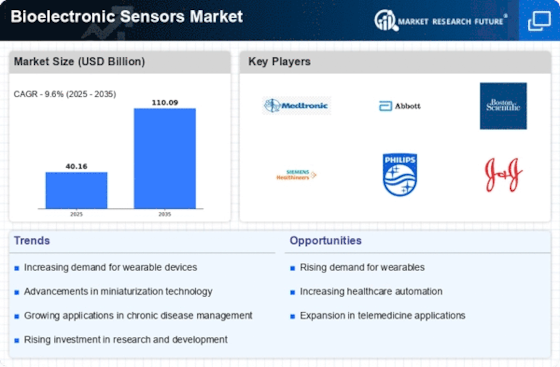

Technological advancements in sensor design are significantly influencing the Bioelectronic Sensors Market. Innovations such as miniaturization, improved sensitivity, and enhanced data processing capabilities are making bioelectronic sensors more effective and user-friendly. For instance, the development of flexible and stretchable sensors allows for better integration with the human body, leading to more accurate readings. Market data suggests that the bioelectronic sensors segment is expected to grow at a compound annual growth rate of 12% over the next five years. These advancements not only improve the performance of bioelectronic sensors but also expand their applications across various fields, including diagnostics and therapeutics, thereby driving the overall market growth.

Increased Investment in Healthcare Technology

The Bioelectronic Sensors Market is benefiting from increased investment in healthcare technology. Governments and private entities are allocating substantial funds to research and development in bioelectronics, aiming to enhance healthcare delivery systems. For example, funding for bioelectronic research has seen a rise of approximately 20% in the last two years, reflecting a growing recognition of the potential of these technologies. This influx of capital is fostering innovation and accelerating the development of new bioelectronic sensors that can provide more accurate and timely health data. Consequently, the Bioelectronic Sensors Market is poised for significant expansion as new products enter the market, catering to diverse healthcare needs.

Regulatory Support for Innovative Medical Devices

Regulatory support for innovative medical devices is a key driver for the Bioelectronic Sensors Market. Regulatory bodies are increasingly recognizing the importance of bioelectronic sensors in enhancing patient care and are streamlining approval processes for these devices. This supportive regulatory environment encourages manufacturers to invest in the development of new bioelectronic sensors. Recent initiatives have been launched to expedite the review of innovative medical technologies, which could potentially shorten the time to market for new products. As a result, the Bioelectronic Sensors Market is likely to see a surge in new entrants and innovations, further propelling market growth and expanding the range of available bioelectronic solutions.