Biodegradable Packaging Size

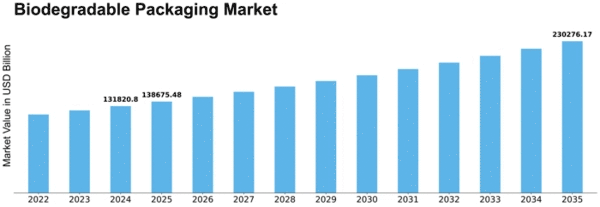

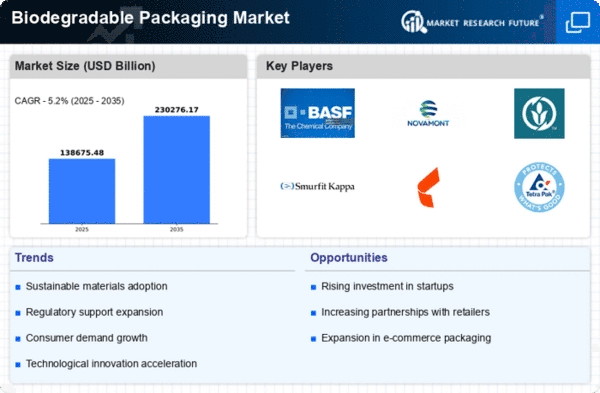

Biodegradable Packaging Market Growth Projections and Opportunities

The Biodegradable Packaging Market faces the challenges of a huge group of affecting market forces which in turn impact its growth and development. The main force that steers the industry forward is the rising care about ecological sustainability combined with the increased consumer awareness. Consumers becoming more aware of the environmental implication associated with the traditional packaging materials thus motivating them to opt for the biodegradable alternatives. A variance in consumer choices fairs to foster businesses picking environment-friendly packaging solutions for having the same beliefs as their customers.

Worldwide Biodegradable Packaging Market Size amounted to USD 89.3 Bn in 2022. Being biodegradable packaging industry is expected to grow from the valuation of USD 95.7 Billion this year to USD 167.0 Billion by 2032, which is a compound annual growth rate (CAGR) of 7.20%.

The regulatory interventions as well are at the core of the emerging features in the biodegradable packaging market. Governments everywhere impose guidelines that restrict the use certain materials which are not biodegradable and promote eco-friendly practices. These legislations support a healthy marketing atmosphere for the biodegradable packaging industry, since the organizations are influenced to maintain environmental standards. Conversely, the attention on cutting down carbon footprint by fighting climate change has sparkled interests in biodegradable packaging material.

It is the other factor that affects the industry resulting from the progress in material science and manufacturing processes. Innovation in biodegradable materials such as bio-based plastics and compostable polymers is opening to more and more feasible alternatives for biodegradable packaging. Manufacturers are at present designing new materials that apart from accomplishing the environmental standards and functionalities of the packaging also ensure durability, which is needed in the application of packaging. This goes on to show how this innovation will be essential in guaranteeing the market’s competitiveness and addressing the many challenges that come along with industries.

Consumer choice and use of goods/services are determinants of market trends. The rising need for eco-friendly, ethically sourced products has become a key driver in the rising use of biodegradable packaging. Brands that are insistent on green packaging and are meeting consumer's expectations have their respective brand image as well, and instill customer loyalty. This implies that manufacturers are now increasingly using bio-degradable packaging as a marketing strategy to lure customers to their brands.

The economics of the area too contributes the environmental packaging market. Among the factors which influence the use of biogradable materials by manufacturers are the pricing of their manufacture and the source of the materials. Besides, the more the market tends to develop and grow, the scale economies are now the factor that influences prices.

Leave a Comment